Malé (Maldives) (AFP) – The International Monetary Fund warned the Maldives against looming “debt distress” Monday, as the small but strategically placed luxury tourist destination looks set to borrow more from main creditor China.

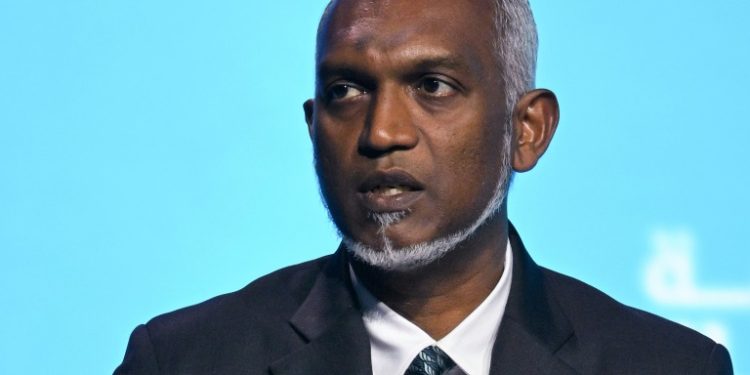

Since winning office last year, President Mohamed Muizzu has reoriented the atoll nation — known for its upmarket beach resorts and celebrity vacationers — away from traditional benefactor India and towards Beijing.

Last month his party won parliamentary elections in a landslide after promising to build thousands of apartments, reclaim more land for urban development and upgrade airports, all with Chinese funding.

Without naming the archipelago’s main lender, the IMF said the Maldives remained “at high risk of external and overall debt distress” without “significant policy changes”.

“Uncertainty surrounding the outlook is high and risks are tilted to the downside, including from delayed fiscal consolidation and weaker growth in key sources markets for tourism,” the IMF said in a statement.

It urged the Maldives to urgently raise revenue, cut spending and reduce external borrowing to avoid a major economic crisis.

The Maldives is a small nation of 1,192 tiny coral islets scattered 800 kilometres (500 miles) across the equator, but it strategically straddles key east-west international shipping routes.

Tourism is a crucial source of foreign exchange for the country, home to white sandy beaches and secluded resorts offering Robinson Crusoe-style holidays.

China has pledged more funding since last year’s victory by Muizzu, who thanked the country for its “selfless assistance” for development funds on a state visit to Beijing shortly after he took power.

Official data showed the Maldives’ foreign debt reaching $4.038 billion last year, about 118 percent of gross domestic product and up nearly $250 million from 2022.

As of June 2023, the Export-Import Bank of China owned 25.2 percent of the Maldives’ external debt and was the country’s biggest single lender, Maldives finance ministry figures showed.

Debt-burdened neighbour Sri Lanka defaulted on its foreign debt in 2022 after a foreign exchange crisis that brought months of food and fuel shortages.

More than 50 percent of Sri Lanka’s bilateral debt is owed to China and the island nation is still struggling to restructure its borrowings with IMF assistance.

Unable to service a huge Chinese loan to build a port in the south, Sri Lanka allowed a Chinese state company to take over the facility on a 99-year lease in 2017.

The deal raised fears about Beijing’s use of “debt traps” in exerting its influence abroad, including in the Indian Ocean.

© 2024 AFP