Washington (AFP) – Retail sales in the United States slipped more than anticipated last month, retreating after the holiday season and bogged down by auto sales and gas prices, government data showed Thursday.

The 0.8 percent seasonally adjusted decline went beyond analyst expectations of a 0.2 percent drop, bringing total sales down to $700.3 billion, the Commerce Department said.

The slide was the biggest in nearly a year and comes after a strong showing in general for the consumer sector in 2023, which — helped by labor market resilience — supported economic growth.

A larger than expected slowdown in spending, if it persists, could dim hopes that consumption continues its role as a key economic driver.

“It’s a weak report, but not a fundamental shift in consumer spending,” said Navy Federal Credit Union corporate economist Robert Frick.

He added that the pullback in January came after the December holiday shopping period, while cold weather put a damper on the situation as well.

Excluding the auto sector, retail sales fell 0.6 percent in January from December.

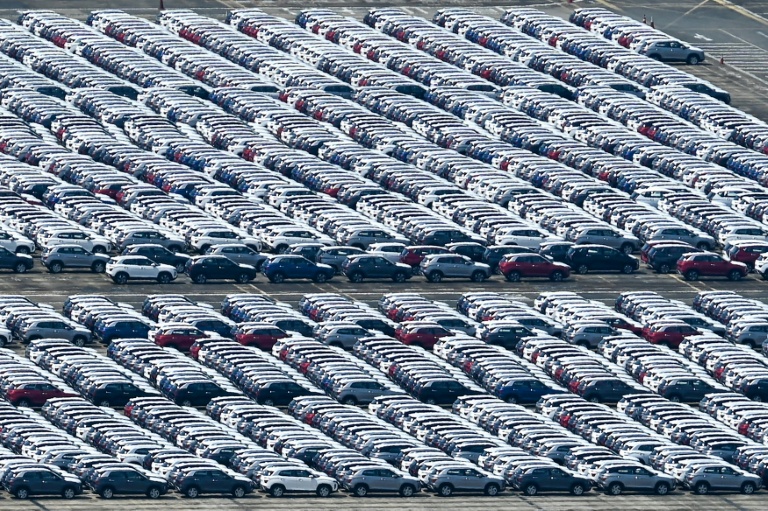

Analysts attribute the auto sector weakening to higher rates on loans and the unwinding of pent up demand after supply chain problems were resolved.

Removing gasoline stations, sales were down 0.8 percent over the same period.

Motor vehicles and parts dealers, as well as gas stations, saw sales drop by 1.7 percent respectively, latest Commerce Department data showed.

Other areas showing weakness included building material and supplies, as well as health and personal care.

But spending at restaurants and bars continued to hold up, expanding 0.7 percent.

– Consumption slowdown? –

The “control” group of goods, watched by analysts, “is pointing to a sharp slowing in consumption” in the first quarter, said Rubeela Farooqi of High Frequency Economics.

That group excludes gasoline, cars and building materials.

But Farooqi added that “we would hesitate to overemphasize one data point.”

While consumers face challenges from higher borrowing costs after the Federal Reserve rapidly hiked interest rates to tame inflation, the central bank is expected to lower rates this year.

“Consumers’ spending was remarkably strong for much of last year, but some softening seems inevitable this year,” said analysts at Pantheon Macroeconomics in a recent report.

The weakening comes as excess savings have “dwindled significantly, and real after-tax income growth is slowing,” they added.

“But a gradual moderation seems much more likely than a collapse, given the recent upturn in consumers’ confidence,” Pantheon said.