London (AFP) – Asian and European equities diverged Wednesday as most dealers sat on their hands before key US inflation data, but London set a new record peak on solid US gains and largely upbeat earnings.

London’s FTSE 100 index rose to 8,474.41 points, extending its record-breaking run rooted also in interest-rate cut hopes. The British capital was further boosted by optimism over credit-rating group Experian and mobile phone giant Vodafone, eclipsing news of slumping profit at luxury fashion firm Burberry.

In the eurozone, Frankfurt climbed toward its recent record but Paris lapsed into negative territory, after Asian markets had wobbled in earlier deals on Wednesday before hotly-awaited US inflation figures.

“US stocks made progress overnight and the FTSE 100 has followed this cue to reach a new record high,” said AJ Bell investment director Russ Mould. “The next test of the prevailing positive sentiment comes tonight with US consumer prices data.”

The consumer price index (CPI) data which will likely play a key role in the Federal Reserve’s decision on when to start cutting interest rates, if at all this year. The CPI report follows readings that came in above expectations in the first three months of the year, denting hopes for a reduction in borrowing costs. However, the data is forecast to show prices slowing down again.

In New York trade on Tuesday, a report showing a forecast-beating rise in April wholesale prices was offset by a downward revision for the previous month. Investors were also digesting a warning from the Fed’s boss that the battle against prices was proving tougher than expected and indicated rates could remain elevated for some time.

“Fed chair Jerome Powell said he did not expect rates to increase again but this (CPI) release is one of a number which could help determine just how soon cuts come,” added Mould.

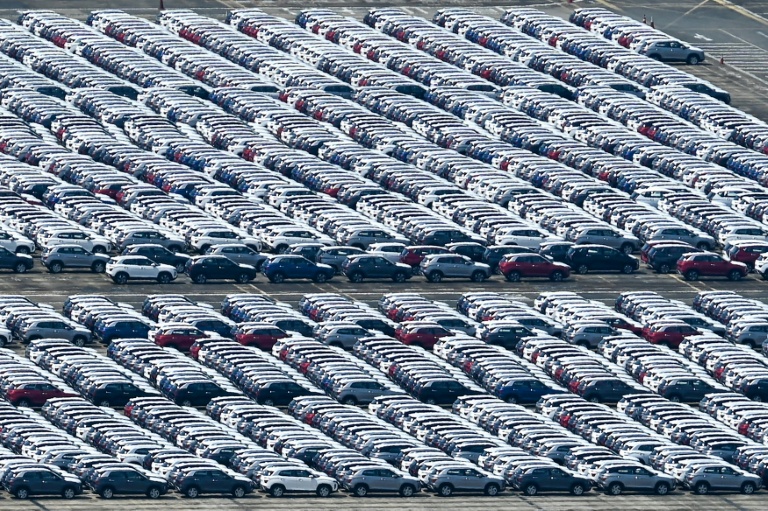

There was also some nervousness on trading floors after Beijing hit out at Washington’s decision to impose steep tariff hikes on Chinese imports such as electric vehicles and semiconductors.

– Key figures around 1045 GMT –

London – FTSE 100: UP 0.3 percent at 8,450.82 points

Paris – CAC 40: DOWN 0.2 percent at 8,207.57

Frankfurt – DAX: UP 0.4 percent at 18,797.95

EURO STOXX 50: FLAT at 5,078.19

Tokyo – Nikkei 225: UP 0.1 percent at 38,385.73 (close)

Shanghai – Composite: DOWN 0.8 percent at 3,119.90 (close)

Hong Kong – Hang Seng Index: Closed for a holiday

New York – Dow: UP 0.3 percent at 39,558.11 (close)

Euro/dollar: UP at $1.0824 from $1.0819 on Tuesday

Dollar/yen: DOWN at 155.75 yen from 156.40 yen

Pound/dollar: UP at $1.2609 from $1.2590

Euro/pound: DOWN at 85.86 from 85.92 pence

Brent North Sea Crude: DOWN 0.2 percent at $82.22 per barrel

West Texas Intermediate: FLAT at $78.01 per barrel

burs-rfj/lth

© 2024 AFP