New York (AFP) – The Dow scored its first-ever finish above 40,000 points Friday in a flourishing end to a week of records after a subdued session in Europe and a rally in some Asian markets.

“We made a breakout to new record high,” Karl Haeling from LBBW told AFP. “The market is just choosing to consolidate, which is probably a healthy thing,” he continued. “Because it’s racing and getting too exuberant.”

The blue-chip index mustered only a 0.3 percent gain, but it was enough to finish at 40,003.59. The S&P 500 also eked out an increase, while the Nasdaq finished narrowly negative.

Global indices had earlier this week hit fresh highs on hopes of interest-rate cuts in the United States and elsewhere on cooler inflation. But European markets were hit Friday by a round of profit-taking.

“One day stock markets are making record highs and banking on rate cuts, the next stocks are giving back gains and rate cut expectations are being pared back,” noted XTB analyst Kathleen Brooks.

– Plans boost China markets –

Back in Asia, Shanghai piled on one percent and Hong Kong extended its recent advance, with shares in Chinese property developers soaring.

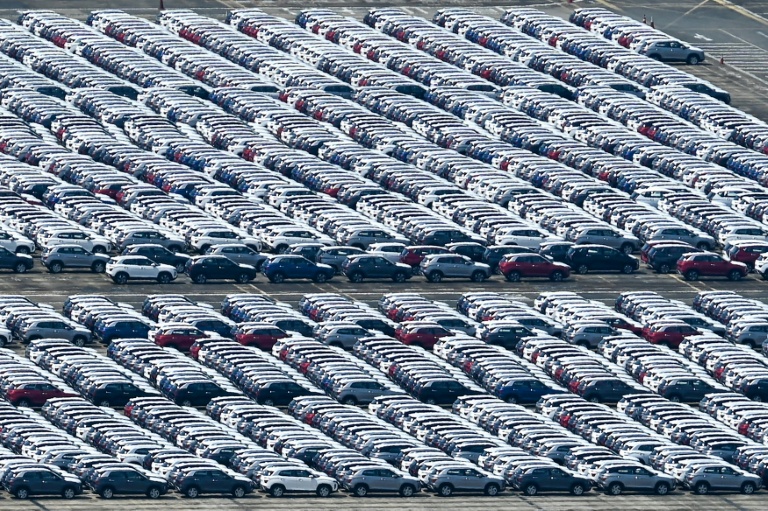

Beijing announced it would cut the minimum down payment rate for first-time homebuyers and suggested the government could buy up commercial real estate. Property and construction accounts for more than a quarter of China’s gross domestic product but the real estate sector has been under unprecedented strain since 2020, when authorities tightened developers’ access to credit in a bid to reduce mounting debt.

Major companies have teetered since then, while falling prices have dissuaded consumers from investing in property. The crisis has put huge pressure on leaders to come up with a plan to help the sector and avoid it spreading to other parts of the economy, but most measures have left investors disappointed.

Officials announced the widest-ranging measures yet at a meeting on Friday attended by regulators, representatives of top banks, local governments and the property market. No details were provided on how many houses would be bought.

State media also cited the central bank and the National Financial Regulatory Administration as saying they would cut the minimum down payment rate for first-time homebuyers to 15 percent, one of the country’s lowest-ever rates. The rate will be cut to 25 percent for second-home purchases, it added.

Pantheon Macro economist Duncan Wrigley gave the news a cautious welcome. “China’s new property support measures are helpful, but no magic bullet,” he said. “The new measures…are a step in the right direction and should speed up the bottoming out of upper-tier city housing markets, but the policy funding amount announced so far is disappointing and will probably need to be increased.”

– Key figures around 2100 GMT –

New York – Dow: UP 0.3 percent at 40,003.59 (close)

New York – S&P 500: UP 0.1 percent at 5,303.27 (close)

New York – Nasdaq Composite: DOWN 0.1 percent at 16,685.97 (close)

London – FTSE 100: DOWN 0.2 percent at 8,420.26 (close)

Paris – CAC 40: DOWN 0.3 percent at 8,167.50 (close)

Frankfurt – DAX: DOWN 0.2 percent at 18,704.42 (close)

EURO STOXX 50: DOWN 0.2 percent at 5,064.14 (close)

Hong Kong – Hang Seng Index: UP 0.9 percent at 19,553.61 (close)

Shanghai – Composite: UP 1.0 percent at 3,154.03 (close)

Tokyo – Nikkei 225: DOWN 0.3 percent at 38,787.38 (close)

Dollar/yen: UP at 155.71 yen from 155.39 yen on Thursday

Euro/dollar: UP at $1.0873 from $1.0867

Pound/dollar: UP at $1.2702 from $1.2670

Euro/pound: DOWN at 85.67 from 85.77 pence

Brent North Sea Crude: UP 0.9 percent at $83.98 per barrel

West Texas Intermediate: UP 1.0 percent at $80.06 per barrel

burs-jmb/dw

© 2024 AFP