New York (AFP) – Stock markets were mixed Friday as investors digested fresh US and eurozone inflation data that could set the tone for interest rate moves by central banks.

Wall Street’s three main indices mostly closed higher after data showed the US Federal Reserve’s preferred metric for inflation remained unchanged in April.

The Dow and broad-based S&P 500 both closed in the green, while the tech-heavy Nasdaq ended the day flat.

The personal consumption expenditures (PCE) index rose at an annual rate of 2.7 percent in April, the same as the previous month and in line with analyst forecasts.

“The key takeaway from the report is that the year-over-year PCE inflation rates did not worsen,” said Briefing.com analyst Patrick O’Hare.

“However, they did not improve either, so it seems unlikely that the Fed would find any new confidence in this report that inflation is moving sustainably toward its two-percent,” he added.

Angelo Kourkafas of Edward Jones said: “We did see some very gradual progress on disinflation, it was marginal.

But I think what’s important is that the trend is lower.”

Bets on the number of Fed rate cuts this year have been whittled down owing to a string of outsize US data and warnings from decision-makers that they want to see strong evidence that prices are under control before moving.

Fed officials “will need to see a sustainable trend toward lower inflation to feel confident enough to lower rates without seeing a snapback in inflation,” said Bret Kenwell, a US investment analyst at eToro.

“We’re not there yet, but the inflation reports in the month of May were a constructive first step,” he said.

The yields for two-year and five-year US Treasury bills, a proxy for interest rates, sank on expectations that the Fed could lower borrowing costs later this year.

In Europe, eurozone consumer inflation rose faster than expected to 2.6 percent in May after 2.4 percent in April, official data showed.

Nevertheless, analysts expect the European Central Bank to cut rates next week.

The Paris stock exchange closed higher but Frankfurt finished flat.

London’s FTSE 100 index was also up while Asia’s main equity markets closed mixed before the US data release.

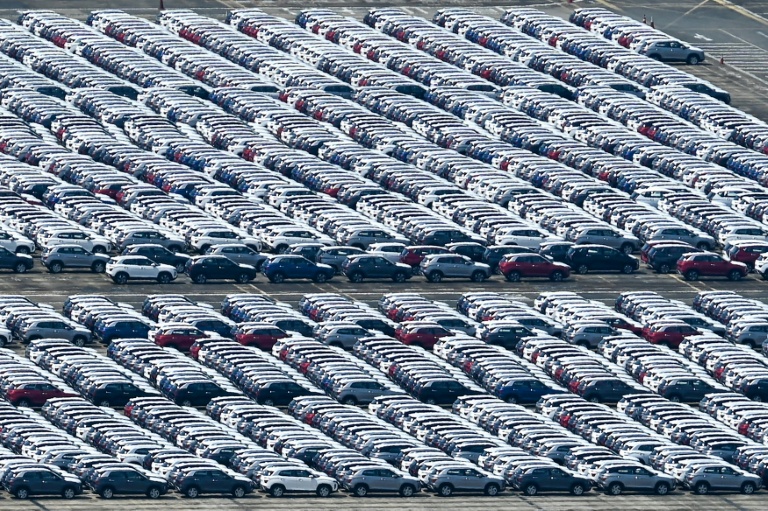

Elsewhere, oil prices fell as China’s factory activity contracted in May for the first time in three months, denting fragile optimism about the recovery in the major crude-consuming economy.

That came before a weekend meeting of the OPEC+ cartel that is likely to maintain its level of output cuts amid a fragile global economy.

Analysts told AFP they expected the status quo to be upheld at the online gathering Sunday even if larger cuts could boost crude prices and income for the grouping’s members, which include Saudi Arabia and Russia.

– Key figures around 2020 GMT –

New York – Dow: UP 1.5 percent at 38,686.32 points (close)

New York – S&P 500: DOWN 0.8 percent at 5,277.51 (close)

New York – Nasdaq: FLAT at 16,735.02 (close)

London – FTSE 100: UP 0.5 percent at 8,275.38 (close)

Paris – CAC 40: UP 0.2 at 7,992.87 (close)

Frankfurt – DAX: FLAT at 18,497.94 (close)

EURO STOXX 50: FLAT at 4,983.67 (close)

Tokyo – Nikkei 225: UP 1.1 percent at 38,487.90 (close)

Hong Kong – Hang Seng Index: DOWN 0.8 percent at 18,079.61 (close)

Shanghai – Composite: DOWN 0.8 percent at 3,086.81 (close)

Euro/dollar: UP at $1.0852 from $1.0834 on Thursday

Pound/dollar: UP at $1.2745 from $1.2733

Dollar/yen: UP at 157.30 from 156.82 yen

Euro/pound: UP at 85.12 from 85.07 pence

West Texas Intermediate: DOWN 1.2 percent at $76.99 per barrel

Brent North Sea Crude: DOWN 0.3 percent at $81.62 per barrel

burs-lth-bys/arp

© 2024 AFP