London (AFP) – The London Stock Exchange is once again Europe’s biggest stock market by valuation after reclaiming the crown from Paris as France is rocked by political turmoil.

The combined market capitalisation of all London-listed companies reached $3.178 trillion at the close on Monday, outpacing Paris on $3.136 trillion, according to Bloomberg data.

London has been boosted in recent months by cooler inflation, growing takeover activity and potential flotations, helping its top-tier FTSE 100 index to record highs, with Brexit in the rear view mirror.

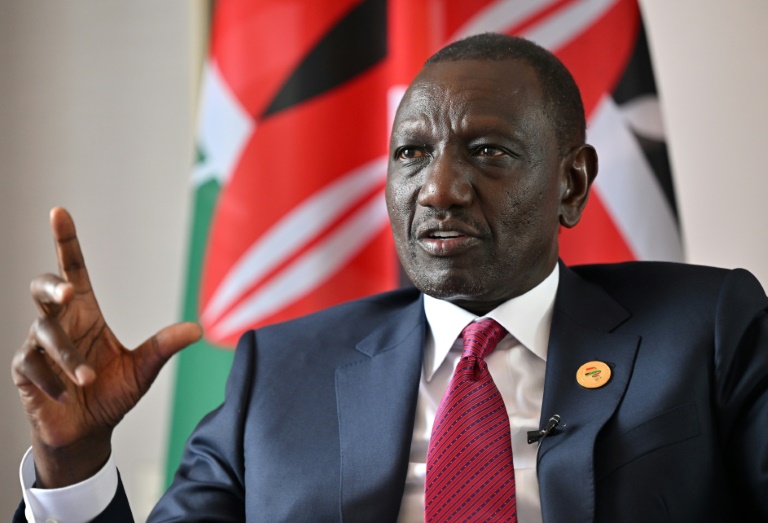

“(President) Emmanuel Macron’s decision to plunge his country into political turmoil has jolted French investors,” noted Danni Hewson, head of financial analysis at stockbroker AJ Bell.

Prior to this week, Paris had been Europe’s biggest stock market since early 2023, after briefly taking the lead in late 2022.

– Far-right surge –

Paris’ benchmark CAC 40 shares index slumped more than six percent last week after Macron called a snap election following a surge in support for the far right in EU parliament polls.

That wiped out gains so far this year — and was its worst weekly performance since March 2022, shortly after Russia invaded Ukraine.

France will hold the first round of its legislative elections on June 30 and the second round on July 7.

Macron’s centrist bloc is currently trailing third in polls behind the far right National Rally (RN) party and a new left-wing alliance New Popular Front, and faces an uphill struggle to narrow the gap with less than two weeks to go.

Investors fear that French public finances could worsen significantly as a result of either tax-cutting policies by the far right — or the repeal of pension reforms by the left.

London’s stock market growth had lagged in recent years, partly as a result of Britain’s departure from the European Union in early 2021.

London, now the world’s sixth biggest stock market by value, is faring well ahead of a UK general election on July 4, when the main opposition Labour party is forecast to defeat the ruling Conservatives, led by Prime Minister Rishi Sunak.

“The steady poll lead of Labour in the UK means a change of the guard has largely been priced in,” Hewson added.

The London Stock Exchange has so far this year attracted £18.8 billion in equity capital — which is more than Frankfurt, Paris, Milan and Stockholm combined, an LSE spokesperson told AFP.

– ‘Feeble’ Paris recovery –

The Paris stock market meanwhile attempted an unconvincing weak recovery on Tuesday.

“Although some of the risk-off sentiment which spread sparked by worries about the far-right gaining legislative power in France has eased off, Paris-listed stocks have made only a feeble recovery,” said Susannah Streeter, head of money and markets at Hargreaves Lansdown.

She added, however, that “hopes have risen slightly that spending pledged by the National Rally party would in practice be curtailed in a hung parliament scenario” in the absence of an absolute majority.

Stock exchange operator Euronext — whose hubs include Amsterdam, Brussels, Dublin, Lisbon, Oslo, Paris, and Milan — declined to comment on the French capital losing the top spot.

Jean-Charles Simon, head of Paris Europlace, which promotes Paris as a financial hub, insisted the battle for supremacy with London was not over.

“The two equity markets have very close valuations, with Paris having closed a significant gap in recent years,” Simon told AFP.

Paris, which like London has also hit record highs this year, has suffered additionally from sharp losses to the share price of French luxury goods giant LVMH as Chinese demand dampens.

LVMH shares slumped almost a fifth over the last 12 months.

© 2024 AFP