London (AFP) – Equity markets and the dollar wavered Monday as investors mulled the impact of the assassination attempt on Donald Trump, while the luxury goods sector was slammed by plunging profits at both British fashion label Burberry and Swiss watch group Swatch.

European stocks edged downwards after a divergent performance in Asia, with the focus mainly on developments in the United States after Trump was wounded Saturday at a rally before this week’s Republican convention.

“Markets were surprisingly calm given the assassination attempt on US presidential candidate Donald Trump,” said AJ Bell analyst Dan Coatsworth. “While equities saw a small pullback in parts of the world, there was no panic on the markets as a result of the weekend of violence.”

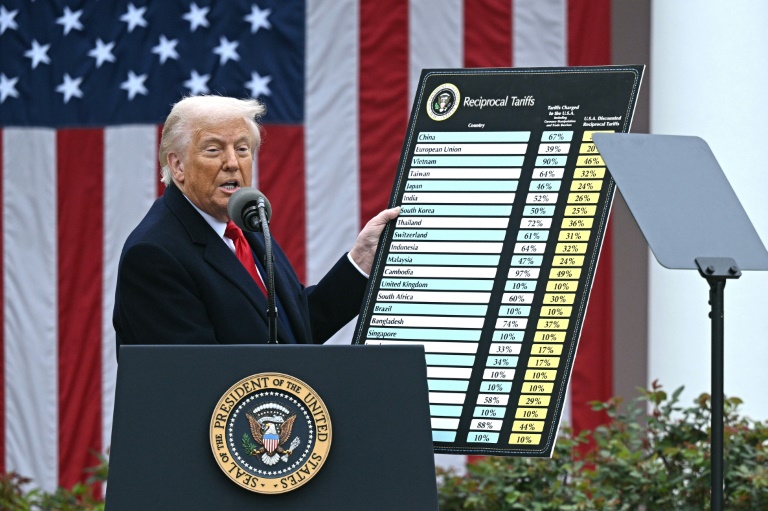

While the odds of him beating President Joe Biden had been rising in recent weeks, they got an extra lift from the shooting. Observers said a Trump victory could see lower corporate taxes — a boost for companies’ bottom lines — but also an increase in tensions with China with fresh tariffs possible.

Investors took the news in their stride. “There has not been an enormous reaction in the markets to the attempted assassination of Donald Trump,” noted Finalto analyst Neil Wilson.

On the corporate front, Burberry stock tumbled 17 percent after it announced the immediate departure of chief executive Jonathan Akeroyd as it posted “disappointing” results with the sector pressured by weak Chinese demand. Another heavy blow came as Swatch posted plunging profits owing to the luxury market crisis in China — warning that sales in the country were likely to remain difficult this year. In Paris, Gucci owner Kering saw its stock slide 3.6 percent and LVMH shed 1.9 percent in value on the back of concerns for the wider luxury sector.

Eyes were also on a key meeting of China’s top leadership in Beijing, with hopes for measures to boost the world’s number two economy, which grew less than expected in the second quarter according to official data Monday.

– Key figures around 1115 GMT –

London – FTSE 100: DOWN 0.3 percent at 8,227.41 points

Paris – CAC 40: DOWN 0.7 percent at 7,672.85

Frankfurt – DAX: DOWN 0.4 percent at 18,673.02

EURO STOXX 50: DOWN 0.5 percent at 5,017.59

Hong Kong – Hang Seng Index: DOWN 1.5 percent at 18,015.94 (close)

Shanghai – Composite: UP 0.1 percent at 2,974.01 (close)

Tokyo – Nikkei 225: Closed for a holiday

New York – Dow: UP 0.6 percent at 40,000.90 (close)

Dollar/yen: UP at 158.00 yen from 157.88 yen on Friday

Euro/dollar: UP at $1.0914 from $1.0906

Pound/dollar: DOWN at $1.2979 from $1.2989

Euro/pound: UP at 84.08 pence from 83.97 pence

Brent North Sea Crude: DOWN 0.1 percent at $84.92 per barrel

West Texas Intermediate: DOWN 0.2 percent at $82.05 per barrel

© 2024 AFP