London (AFP) – Europe’s stock markets slid Wednesday as stronger-than-expected UK inflation data doused hopes of a British interest rate cut any time soon.

The increasing prospect of a US rate reduction also weighed on the dollar, helping push gold, a haven investment that is priced in the currency, to another record peak.

London and eurozone equities slid after official data showed that UK inflation held at 2.0 percent in June from May, stronger than forecast.

The British pound jumped close to a one-year high above $1.30 as investors also bet that the Federal Reserve was set to start reducing American borrowing costs soon.

Gold prices spiked to $2,482.42 per ounce, while the yen also rallied.

“European markets are continuing their downbeat tone,” said Scope Markets analyst Joshua Mahony.

“Today’s big-ticket news out of Europe came from the UK with inflation coming in higher than expected.”

The 2.0 percent increase of Britain’s Consumer Prices Index came in above market forecasts of 1.9 percent, which could cause the Bank of England to sit tight for a while longer before starting to cut rates.

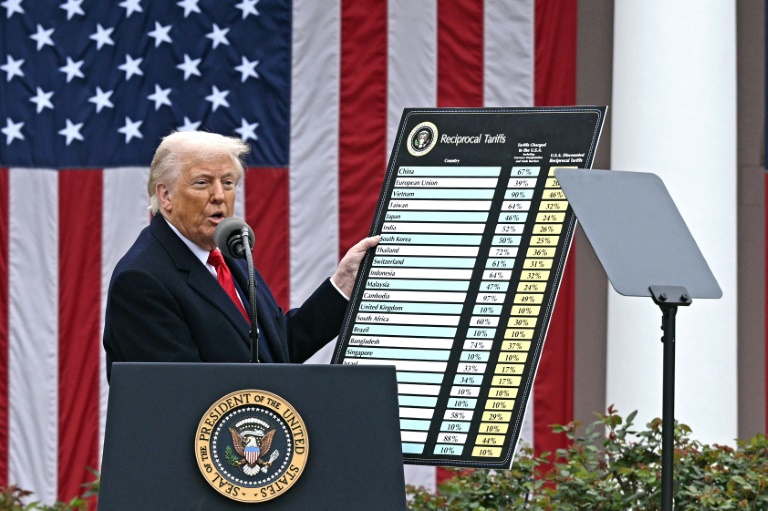

In Asia, stock markets saw mixed fortunes as expectations for a US rate cut played out against the prospect of another Donald Trump presidency, which analysts warn could see inflation-fuelling tax cuts and import tariffs.

Adding to the upbeat tone was US retail sales data on Tuesday that smashed expectations, leading observers to lift their economic growth outlook.

While Wall Street saw another day of record highs owing to bets on lower borrowing costs and a more market-friendly White House, Asian dealers trod more cautiously as they also kept tabs on a key economic meeting of China’s leaders in Beijing this week.

– Key figures around 1100 GMT –

London – FTSE 100: DOWN 0.2 percent at 8,147.38 points

Paris – CAC 40: DOWN 0.4 percent at 7,551.54

Frankfurt – DAX: DOWN 0.6 percent at 18,414.12

EURO STOXX 50: DOWN 1.1 percent at 4,896.74

Tokyo – Nikkei 225: DOWN 0.4 percent at 41,097.69 (close)

Hong Kong – Hang Seng Index: UP 0.1 percent at 17,739.41 (close)

Shanghai – Composite: DOWN 0.5 percent at 2,962.85 (close)

New York – Dow: UP 1.9 percent at 40,954.48 (close)

Pound/dollar: UP at $1.3035 from $1.2974 on Tuesday

Euro/dollar: UP at $1.0930 from $1.0903

Dollar/yen: DOWN at 156.75 yen from 158.39 yen

Euro/pound: DOWN at 83.87 pence at 84.01 pence

West Texas Intermediate: UP 0.5 percent at $81.16 per barrel

Brent North Sea Crude: UP 0.2 percent at $83.93 per barrel

© 2024 AFP