New York (AFP) – Wall Street’s main indices mostly tumbled Wednesday as fears of heightened trade tensions with China hit tech stocks.

The increasing prospect of a US rate reduction also weighed on the dollar, helping push gold, a haven investment that is priced in the currency, to another record peak.

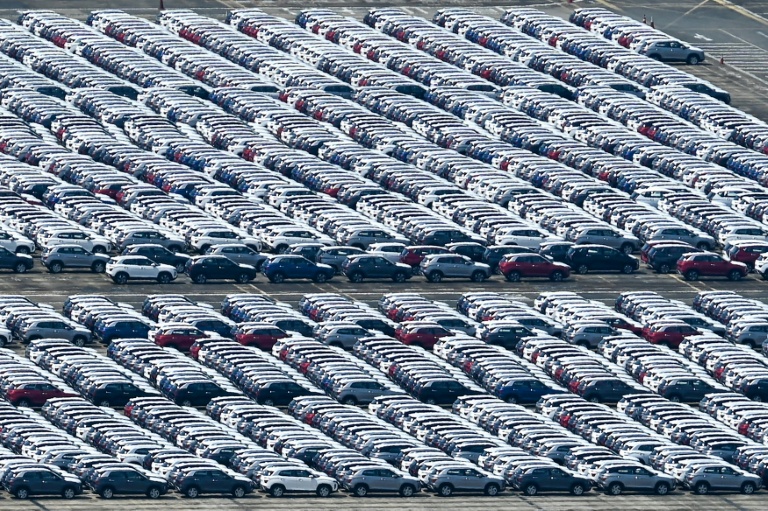

The tech-heavy Nasdaq slumped by 2.8 percent to finish the day, and the broad S&P 500 dropped 1.4 percent as investors worried about renewed trade tensions with China.

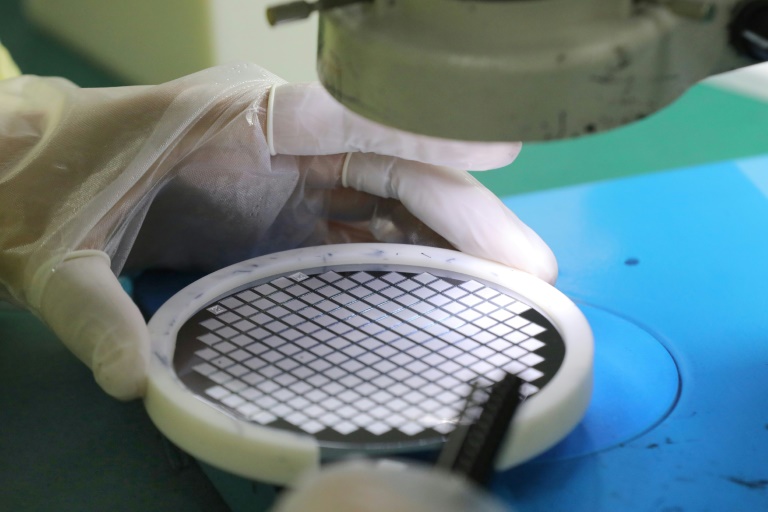

“A Bloomberg report that the Biden Administration is discussing tighter export restrictions for semiconductors and semiconductor equipment going to China has caused an upsetting stir,” said market analyst Patrick O’Hare of Briefing.com.

Shares in artificial intelligence chipmaker Nvidia fell 6.6 percent, while those in ASML, which manufactures the equipment to make computer chips, tumbled 12.7 percent.

“Separately, a remark from former President Trump that Taiwan should be paying the U.S. for its defense has created some geopolitical angst that is also weighing on the semiconductor group,” O’Hare added.

Tech stocks, in particular Nvidia, have been on a tear in recent months over the boom in the development of artificial intelligence applications, helping drive Wall Street to new records.

The Dow, however, pushed to a third straight record high on Wednesday.

In Europe, London equities held steady, closing 0.3 percent in the green despite stronger-than-expected UK inflation data dousing hopes of a British interest rate cut anytime soon.

“The Bank of England requires a higher level of certainty in order to actually lower rates,” said Patrick Munnelly of broker Tickmill.

Elsewhere in Europe, Paris and Frankfurt closed lower.

UK inflation holding steady at 2.0 percent in June from May, stronger than forecast, helped push the British pound close to a one-year high above $1.30.

Investors expect that the Federal Reserve is set to start reducing American borrowing costs soon.

Gold prices spiked to $2,482.42 per ounce, while the yen also rallied.

In Asia, stock markets saw mixed fortunes as expectations for a US rate cut played out against the prospect of another Donald Trump presidency, which analysts warn could see inflation-fueling tax cuts and import tariffs.

– Key figures around 2030 GMT –

New York – Dow: UP 0.6 percent at 41,198.08 points (close)

New York – S&P 500: DOWN 1.4 percent at 5,588.27 (close)

New York – Nasdaq Composite: DOWN 2.8 percent at 17,996.92 (close)

London – FTSE 100: UP 0.3 percent at 8,187.46 (close)

Paris – CAC 40: DOWN 0.1 percent at 7,570.81 (close)

Frankfurt – DAX: DOWN 0.4 percent at 18,437.30 (close)

EURO STOXX 50: DOWN 1.1 percent at 4,891.46 (close)

Tokyo – Nikkei 225: DOWN 0.4 percent at 41,097.69 (close)

Hong Kong – Hang Seng Index: UP 0.1 percent at 17,739.41 (close)

Shanghai – Composite: DOWN 0.5 percent at 2,962.85 (close)

Pound/dollar: UP at $1.3012 from $1.2974 on Tuesday

Euro/dollar: UP at $1.0941 from $1.0903

Dollar/yen: DOWN at 156.33 yen from 158.39 yen

Euro/pound: UP at 84.07 pence at 84.01 pence

West Texas Intermediate: UP 2.6 percent at $82.85 per barrel

Brent North Sea Crude: UP 1.6 percent at $85.08 per barrel

burs-rl-bys/bfm

© 2024 AFP