London (AFP) – Wall Street stock markets rose Monday despite Joe Biden’s decision to drop out of the US presidential race fuelling fresh uncertainty.

Biden on Sunday gave in to weeks of calls for him to step aside in the wake of a poor debate performance that amplified questions about his health, and endorsed Vice President Kamala Harris to succeed him.

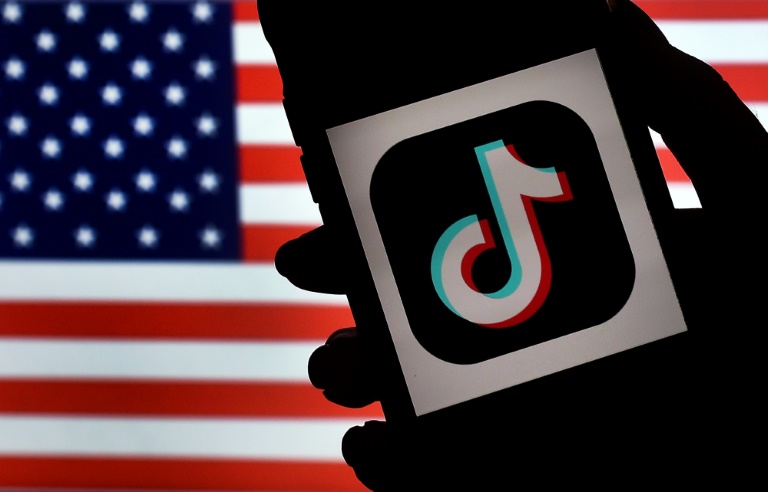

The news has left traders wondering who will go head to head with Donald Trump in the battle to lead the world’s biggest economy, although Harris is seen as the likely Democratic candidate.

“The ‘Harris trade’ has seen US stock index futures rise at the start of the week,” Kathleen Brooks, research director at XTB, said before markets opened.

But, she added, “it is too early to tell if the ‘Harris trade’ will cause a bounce back in US equities after last week’s bruising declines.”

Stocks fell heavily at the end of last week following a crash in global computer systems that hit airports, airlines, trains, banks, shops and even doctors’ appointments.

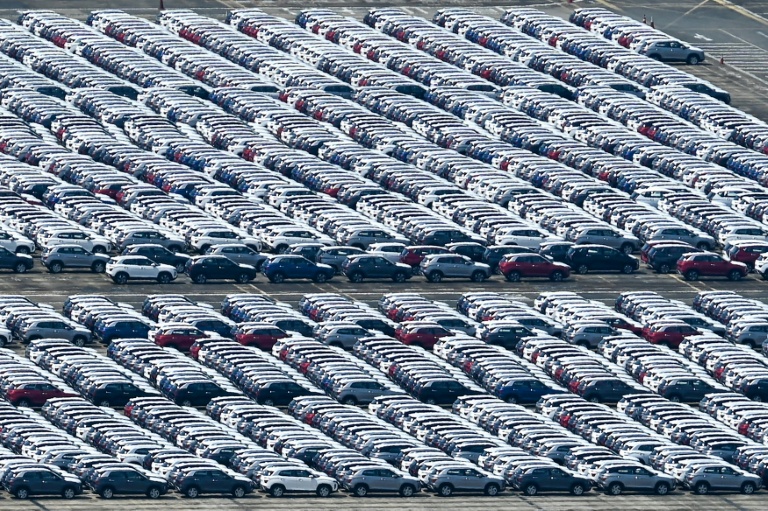

It came at the end of a week where tech stocks had already taken a beating on a growing “Trump trade” as investors worried that the Republican nominee will ramp up a trade dispute with China.

Despite growing expectations last week that Biden would pull out of the race, the move has added doubts that could create volatility in markets, with second quarter earnings from tech companies in the coming weeks also a source of uncertainty.

Briefing.com analyst Patrick O’Hare said “uncertainty has not permeated the marketplace, at least not in an adverse way”, with tech stocks with large capitalisation set to rebound. Tech stocks have largely driven the record-setting rally on enthusiasm for artificial intelligence and investors will be scrutinising the performance of firms.

Europe’s major stock markets rose strongly in afternoon trading, led by Paris and Frankfurt which each recorded gains over one percent, while most Asian markets ended lower.

The dollar initially rose after Biden’s announcement but gave up its gains against the euro and pound.

– Ryanair dives –

In trading Monday — which coincided with the start of Britain’s Farnborough airshow — Ryanair’s share price slumped around 14 percent.

The Irish no-frills carrier warned that despite rising passenger demand for its routes across Europe, revenue would continue to suffer from average air fares remaining lower than expected.

“While travel demand has bounced back since the pandemic, travellers are reluctant to book too far ahead,” said Dan Coatsworth, investment analyst at AJ Bell.

He cited “high interest rates” and passengers “holding out for a bargain” as likely reasons for Ryanair and rival carriers needing to lower air fares in the peak summer season.

Elsewhere, there was little reaction to news that China’s central bank had cut borrowing costs as leaders look to kickstart the world’s number two economy, which has been hammered by a huge property crisis and weak consumer demand.

The Bank of China lowered the one-year and five-year loan prime rates in a bid to encourage commercial banks to grant more credit.

– Key figures around 1330 GMT –

New York – Dow: UP 0.3 percent at 40,411.03 points

New York – S&P 500: UP 0.7 percent at 5,542.61

New York – Nasdaq Composite: UP 1.1 percent at 17,921.16

London – FTSE 100: UP 0.9 percent at 8,229.38

Frankfurt – DAX: UP 1.5 percent at 18,446.15

Paris – CAC 40: UP 1.4 percent at 7,640.93

EURO STOXX 50: UP 1.6 percent at 4,904.68

Tokyo – Nikkei 225: DOWN 1.2 percent at 39,599.00 (close)

Hong Kong – Hang Seng Index: UP 1.3 percent at 17,635.88 (close)

Shanghai – Composite: DOWN 0.6 percent at 2,964.22 (close)

Euro/dollar: DOWN at $1.0883 from $1.0885 on Friday

Pound/dollar: UP at $1.2915 from $1.2914

Dollar/yen: DOWN at 156.85 yen from 157.47 yen

Euro/pound: DOWN at 84.25 pence at 84.27 pence

West Texas Intermediate: DOWN 0.9 percent at $79.43 per barrel

Brent North Sea Crude: DOWN 0.8 percent at $81.98 per barrel

burs-rl/lth

© 2024 AFP