London (AFP) – European and Asian stock markets diverged along with the dollar Tuesday after a rally on Wall Street as traders assessed the outlook for interest rates in the United States and Europe. Investors were looking ahead to US inflation data due Wednesday, the eve of an interest-rate decision from the European Central Bank.

“Tomorrow’s US inflation figures could be the next key test of investor sentiment,” noted AJ Bell investment director Russ Mould. The Federal Reserve is widely seen cutting US interest rates at next week’s meeting, but debate surrounds whether it will be by 25 or 50 basis points, with some arguing that going for the bigger option could suggest decision-makers are worried.

With Friday’s US non-farm payrolls showing the labour market slowing faster than expected, concerns are growing that the world’s top economy is headed for recession, which sent stocks tumbling last week. “Financial markets have shifted their focus from bringing down inflation to shoring up economic growth,” said Saira Malik, chief investment officer at asset manager Nuveen. “Market volatility has climbed amid downside surprises in macroeconomic data — especially labour market indicators.”

Official data in Britain on Tuesday showed wages grew at the slowest pace in two years, indicating that the Bank of England could next week decide against cutting interest rates for a second meeting in a row. The pound firmed against the dollar and euro on the data, while London’s FTSE 100 stock index — featuring numerous multinationals earning in the US currency — dropped.

In the eurozone, Paris climbed and Frankfurt dipped in early afternoon deals. All three main indices on Wall Street closed up more than one percent on Monday, which followed steep pre-weekend falls as tech stocks slumped. Fresh worries about China’s economy are also dampening sentiment, with a mixed bag on trade doing little to encourage investors and weighing on oil prices.

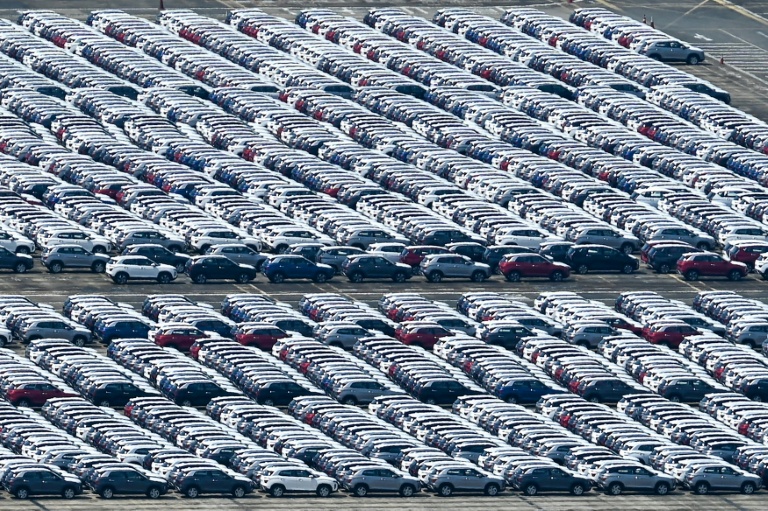

Data showed exports jumped in August but imports fell well short of expectations as the country’s leaders struggle to boost consumption. That came a day after news that inflation rose less than expected in July, reinforcing the view that moves to boost consumer demand and business activity have not taken hold.

China’s leaders are now facing pressure to unveil fresh stimulus for the world’s number two economy, although they have shown little desire to embark on the bazooka-like spending seen during the global financial crisis.

– Key figures around 1045 GMT –

London – FTSE 100: DOWN 0.5 percent at 8,234.17 points

Paris – CAC 40: UP 0.4 percent at 7,455.51

Frankfurt – DAX: DOWN 0.1 percent at 18,434.64

Tokyo – Nikkei 225: DOWN 0.2 percent at 36,159.16 (close)

Hong Kong – Hang Seng Index: UP 0.2 percent at 17,234.09 (close)

Shanghai – Composite: UP 0.3 percent at 2,744.19 (close)

New York – Dow: UP 1.2 percent at 40,829.59 (close)

Euro/dollar: DOWN at $1.1039 from $1.1041 on Monday

Pound/dollar: UP at $1.3096 from $1.3075

Dollar/yen: UP at 143.12 yen from 143.11 yen

Euro/pound: DOWN at 84.31 pence from 84.42 pence

West Texas Intermediate: DOWN 0.9 percent at $68.08 per barrel

Brent North Sea Crude: DOWN 0.8 percent at $71.30 per barrel

© 2024 AFP