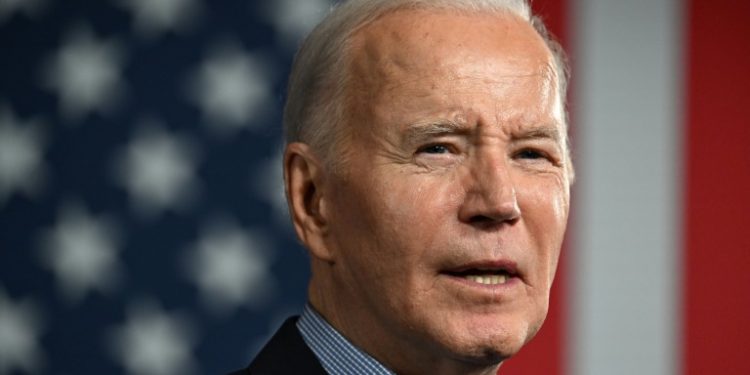

Washington (AFP) – President Joe Biden’s ambitious 2025 budget proposal, published Monday, is almost certain to be dead on arrival in the sharply divided US Congress ahead of national elections later this year. Instead, the 2025 budget serves as a blueprint of the administration’s policy priorities, and highlights the sharp divisions between Democrats and Republicans ahead of Biden’s likely rematch with former president Donald Trump in November.

In a speech in Washington on Monday before the proposals were published, Biden touted the US economy as a “great comeback story.” “Nearly 15 million new jobs created so far, that’s a record. Growth is strong. Wages are rising. Inflation is down,” he said.

Here’s what is in the budget proposal, why it is unlikely to pass in Congress, and what it means for the upcoming elections:

– What’s in the budget? –

The $7.3 trillion budget plan contains a number of populist measures proposed previously — without success — including a 25 percent minimum tax rate for the wealthiest Americans, and a hike in the corporate tax rate from 21 percent to 28 percent. It includes plans to strengthen social spending programs, such as restoring a popular child tax credit, and allocates almost $260 billion to “build or preserve” two million housing units, according to a statement from the White House. In line with Biden’s previous proposals, the 2025 budget would ensure that “people making under $400,000 will not pay a single penny more in taxes,” Biden’s budget director, Shalanda Young, told reporters Monday.

– Question over deficit? –

Under Biden’s plan, the deficit over the next decade would be $3 trillion lower than under its current trajectory, according to White House estimates. However, the national debt — currently at $34.5 trillion — would continue to increase. The reduction to the deficit would be paid for through increased taxes for the wealthy and corporations, and by “closing tax loopholes and cutting wasteful spending on Big Pharma, Big Oil, corporate jets and other special interests, and cracking down on wealthy tax cheats,” according to the White House statement. “The investments in the President’s budget are fully paid for,” US Treasury Secretary Janet Yellen said in a statement. She added that the deficit reduction would come “through a combination of smart savings and tax proposals that ensure wealthy individuals and large corporations pay their fair share.”

While many of the policies in this budget proposal are popular with the Democratic base, they face stiff opposition from Republicans as well as more moderate Democrats and independents in Congress, underscoring the challenge the administration now faces. “The price tag of President Biden’s proposed budget is yet another glaring reminder of this Administration’s insatiable appetite for reckless spending and the Democrats’ disregard for fiscal responsibility,” Republican leaders, including House Speaker Mike Johnson, wrote in a statement posted to X, formerly Twitter. “Biden’s budget doesn’t just miss the mark — it is a roadmap to accelerate America’s decline,” they claimed, accusing the president of seeking to “advance his left-wing agenda.”

– Could it pass? –

Given the stalemate between Republicans and Democrats over the current budget — which has yet to be fully adopted — Congress is highly unlikely to pass anything resembling Biden’s proposal by the end of the current fiscal year on September 30. Given the looming elections, in which all seats in the House of Representatives and one third of the Senate are up for grabs, along with the presidency, the divisions between the two parties are only likely to grow in the coming months. Consequently, Monday’s budget proposal reads as more of a wish list of progressive policy proposals for the campaign trail than a long-term plan for funding the US government.

© 2024 AFP