Over the past century, the United States has undergone remarkable transformations in its economic landscape, navigating through periods of prosperity, adversity, and resilience. From the Roaring Twenties to the Great Depression, from the stagflation of the 1970s to the technological revolution of the 21st century, the US economy has weathered numerous storms and emerged stronger, demonstrating remarkable resilience in the face of challenges. This article delves into the key economic periods of the last 100 years, exploring how the US economic evolution tackled inflation and other economic hurdles along the way.

The Roaring Twenties and the Great Depression (1920s-1930s):

The 1920s in the United States were characterized by unprecedented economic growth, cultural dynamism, and technological innovation, earning the decade its moniker, “The Roaring Twenties.” Following World War I, the nation experienced optimism and prosperity driven by industrial expansion, urbanization, and the emergence of consumer culture.

Economic Boom: The 1920s witnessed robust economic expansion, with thriving industries such as manufacturing, automobiles, and construction. Technological advancements, including mass production techniques, led to increased productivity and improved living standards.

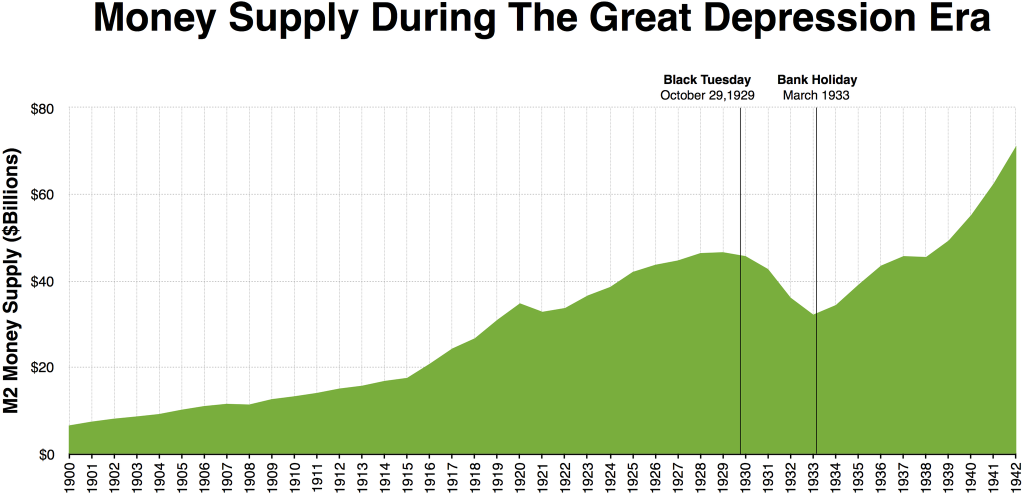

Stock Market Speculation: The era was marked by a surge in stock market speculation fueled by easy credit and lax regulations. However, the speculative bubble burst in October 1929, leading to the infamous stock market crash and signaling the onset of the Great Depression.

The Great Depression: The stock market crash of 1929 triggered the Great Depression, the most severe economic downturn in modern history. The ensuing cascade of bank failures, business closures, and widespread unemployment plunged millions into poverty and destitution.

Human Impact and Social Unrest: The Great Depression had profound human consequences, with families struggling to survive, facing eviction, hunger, and homelessness. Social unrest simmered as protests, strikes, and marches demanded relief and reform.

Government Response – The New Deal: President Franklin D. Roosevelt launched the New Deal, a series of reform programs aimed at providing relief, recovery, and reform. Initiatives included public works projects, financial regulation, and social welfare programs like Social Security, aiming to stimulate economic activity and create jobs.

Legacy and Lessons Learned: The Great Depression reshaped economic policies, social attitudes, and political dynamics, emphasizing the importance of government intervention in stabilizing the economy. The New Deal’s legacy continues to influence debates over economic inequality, social welfare, and financial regulation, serving as a cautionary tale about the dangers of speculative excess and the need for prudent oversight.

Post-World War II Reconstruction and the Golden Age (1940s-1950s):

The period following World War II in the United States marked a transformative era of reconstruction, economic growth, and unprecedented prosperity, often referred to as the “Golden Age.” Emerging from the ravages of war, the nation embarked on ambitious efforts to rebuild infrastructure, revitalize industries, and foster global stability.

War-Time Mobilization and Economic Expansion: During World War II, the US economy underwent a dramatic transformation, transitioning from a peacetime economy to a wartime powerhouse. The war effort spurred mass mobilization of resources, with industries churning out munitions, military equipment, and supplies. The demand for labor soared, leading to a surge in employment and wage growth.

The Marshall Plan and Global Reconstruction: In the aftermath of World War II, the United States played a pivotal role in the reconstruction of war-torn Europe through the implementation of the Marshall Plan. This ambitious initiative provided billions of dollars in economic aid to Western European countries, facilitating infrastructure redevelopment, economic modernization, and political stability. The Marshall Plan not only aided in Europe’s recovery but also fostered global trade and investment, laying the groundwork for post-war prosperity.

Technological Advancements and Industrial Innovation: The post-war period witnessed significant technological advancements and industrial innovation, driving productivity gains and economic growth. Breakthroughs in sectors such as aviation, electronics, and telecommunications revolutionized commerce, transportation, and communication. The widespread adoption of new technologies fueled economic expansion and facilitated the transition to a modern, industrialized economy.

Consumer Culture and Suburban Expansion: The post-war period also saw the rise of consumer culture and suburban expansion, fueled by rising incomes, government incentives, and the availability of affordable housing. The GI Bill provided education and housing benefits to returning veterans, spurring demand for homeownership and fueling suburbanization. The proliferation of automobiles and the development of interstate highways further facilitated suburban growth and mobility.

Keynesian Economics and Government Intervention: The economic policies of the post-war era were heavily influenced by the principles of Keynesian economics, which advocated for government intervention to stabilize the economy and promote full employment. The implementation of fiscal stimulus measures, including public works projects and infrastructure investment, played a crucial role in sustaining economic growth and stability.

Stagflation and Policy Challenges (1960s-1970s):

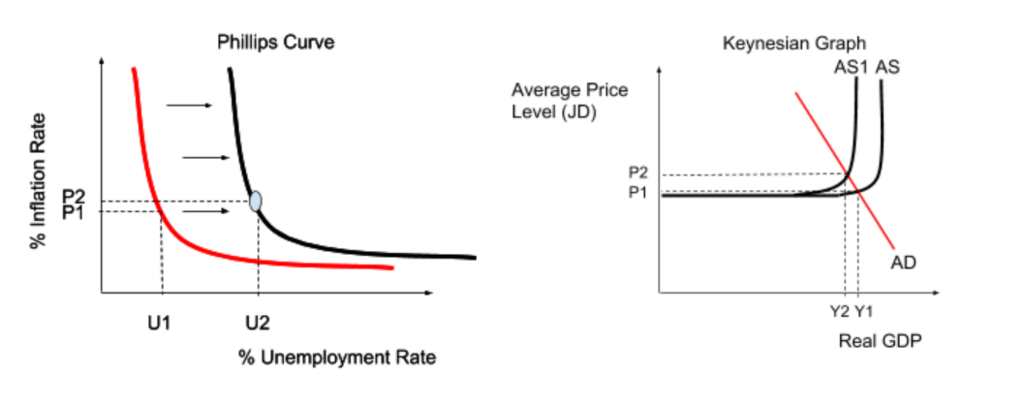

The 1960s and 1970s in the United States were marked by a unique economic phenomenon known as stagflation, characterized by stagnant economic growth coupled with high inflation and unemployment—a conundrum that posed significant challenges to policymakers and economists alike.

Economic Landscape: The 1960s began with economic expansion fueled by post-war prosperity, technological innovation, and government spending. However, as the decade progressed, inflationary pressures emerged due to increased government spending, rising wages, and expansionary monetary policies.

Oil Price Shocks: The 1970s brought about significant economic shocks, particularly the oil price shocks of 1973 and 1979. These disruptions, triggered by geopolitical tensions in the Middle East, led to sharp increases in oil prices and exacerbated inflationary pressures.

Monetary Policy Dilemma: The stagflationary environment presented policymakers with a challenging dilemma. Traditional Keynesian policies proved ineffective in addressing simultaneous inflationary and recessionary pressures, complicating efforts to stimulate economic growth without exacerbating inflation or unemployment.

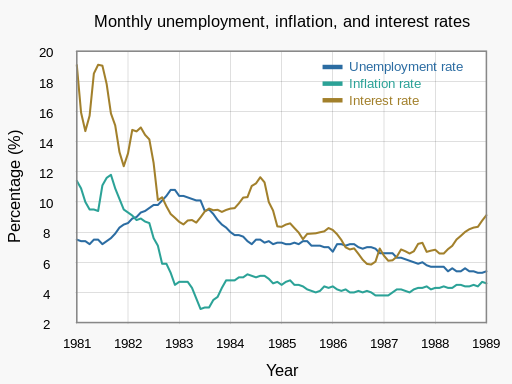

Volcker’s Anti-Inflation Crusade: Amid mounting inflationary pressures, Federal Reserve Chairman Paul Volcker implemented bold monetary policies in the late 1970s to rein in inflation. Volcker’s approach, characterized by tight monetary policy and high interest rates, aimed to break the inflationary spiral and restore confidence in the economy.

Legacy and Lessons Learned: The stagflationary experience challenged conventional economic wisdom and underscored the importance of credible monetary policy and fiscal discipline. The era highlighted the complexities of macroeconomic management and continues to inform contemporary debates over policy responses to economic fluctuations.

The Reagan Revolution and Economic Revival (1980s-1990s):

The 1980s in the United States marked a transformative period of economic policy known as the Reagan Revolution, aimed at stimulating economic growth, reducing government intervention, and promoting free-market principles.

Economic Landscape: Entering the 1980s, the US faced stagflation, high inflation, and sluggish growth. Ronald Reagan, assuming office in 1981, pursued an ambitious economic agenda centered on supply-side economics and deregulation.

Supply-Side Economics and Tax Cuts: The Reagan administration implemented supply-side economics, reducing tax rates to stimulate investment, productivity, and growth. The Economic Recovery Tax Act of 1981 slashed marginal income tax rates, incentivizing investment and entrepreneurship.

Deregulation and Free-Market Principles: Reagan also pursued deregulation to reduce government intervention and foster competition and innovation. Deregulation in industries like telecommunications and finance aimed to spur efficiency and growth.

Monetary Policy and Inflation Fighting: Inflation fighting through monetary policy was prioritized alongside fiscal measures. Federal Reserve Chairman Paul Volcker’s tight monetary policies, aimed at curbing inflation, laid the foundation for long-term stability and expansion.

Economic Expansion and Innovation: Tax cuts, deregulation, and stable monetary policy fueled robust economic expansion and technological innovation. Industries like information technology and finance experienced rapid growth, driving productivity gains and creating wealth.

Legacy and Impact: The Reagan Revolution reshaped economic policies and political discourse, credited with revitalizing the economy, spurring investment, and laying the groundwork for sustained growth. However, widening income inequality and fiscal challenges raised concerns about the equity and sustainability of economic policies.

The New Millennium: Technological Innovation and Economic Challenges (2000s-present):

The dawn of the new millennium in the United States ushered in an era of rapid technological innovation, globalization, and economic transformation. Despite unprecedented advancements in information technology and digitalization, this period also brought significant economic challenges, including the bursting of the dot-com bubble and the 2008 financial crisis.

Technological Innovation and Internet Revolution: The early 2000s saw the continuation of the internet revolution, with widespread adoption of broadband internet, e-commerce platforms, and social media networks. Technological advancements transformed industries, driving productivity gains and fostering innovation.

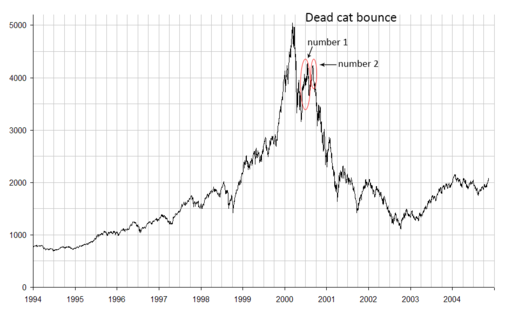

Dot-Com Bubble and Bust (2000-2001): The dot-com bubble, fueled by speculative excess, peaked in the late 1990s and early 2000s before bursting in 2000. The collapse led to a downturn in the stock market, job losses, bankruptcies, and economic retrenchment.

Financial Crisis and Great Recession (2008-2009): The 2008 financial crisis, triggered by the collapse of the subprime mortgage market, led to a severe economic downturn. The Great Recession resulted in mass layoffs, rising unemployment, and prolonged economic hardship.

As we reflect on the past century of economic evolution in the United States, one thing becomes clear: the resilience and adaptability of the US economy have been key drivers of its success. From the depths of the Great Depression to the heights of the technological revolution, the US economy has demonstrated an ability to overcome adversity and emerge stronger than before. While challenges such as inflation have posed significant hurdles along the way, innovative policies, technological advancements, and a dynamic entrepreneurial spirit have enabled the United States to navigate through turbulent times and continue its journey towards prosperity and progress.