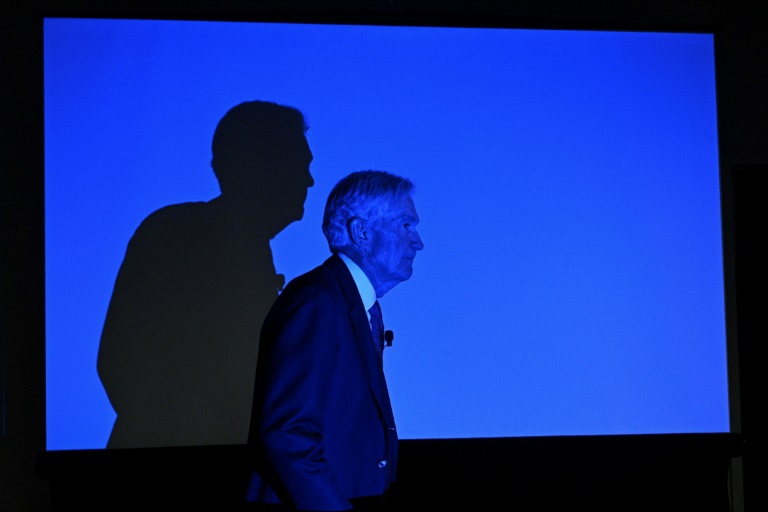

London (AFP) – The Bank of England was set to hold its interest rate steady on Thursday despite slowing UK inflation, with higher price risks and Britain’s looming election preventing a cut, according to analysts. Ahead of the 1100 GMT announcement, the Swiss National Bank unveiled a second straight interest-rate cut, after becoming in March the first Western central bank to slash borrowing costs that had been raised to battle inflation.

Norway froze rates Thursday.

The BoE was widely forecast to keep its cost of borrowing at 5.25 percent, a 16-year high, following a regular monetary policy meeting. While UK inflation slowed in May to a near three-year low of 2.0 percent, matching the central bank’s target, analysts say the BoE is unlikely to cut rates ahead of the election to avoid appearing to take sides.

“Despite inflation falling back to target, the BoE isn’t expected to cut rates” Thursday, noted ARJ Capital analyst Manoj Ladwa. “Given the upcoming UK general election on July 4th, traders are instead expecting the bank to cut rates in August.”

– ‘Political bias’ –

Julian Jessop, economics fellow at the Institute of Economic Affairs think tank, said the BoE would likely sit tight as UK services inflation remains well above two percent, while energy bills are set to rise towards the end of the year. Nevertheless, the central bank “should not hesitate to cut interest rates, even during an election campaign. “Importantly, the Bank should avoid the perception of political bias in either direction and make their decision on the basis of the better news on the inflation data,” Jessop added.

Analysts argued that the inflation drop, while handing a boost to embattled Prime Minister Rishi Sunak, was unlikely to prevent his Conservatives from losing the election to the main opposition Labour party. Keir Starmer’s Labour has consistently led the Conservatives by around 20 points in opinion polls for nearly two years. Elevated interest rates have meanwhile worsened a UK cost-of-living squeeze because they increase borrowing repayments, thereby cutting disposable incomes and crimping economic activity.

The BoE began a series of rate hikes in late 2021 to combat inflation, which rose after countries emerged from Covid lockdowns and accelerated after the invasion of Ukraine by key oil and gas producer Russia. After peaking at 11.1 percent in October 2022, consumer price growth has cooled following a series of interest-rate hikes by the UK central bank.

Britain’s economy, however, stagnated in April after emerging from recession in the first quarter of the year, as businesses and households weathered the cost-of-living crunch. Should the BoE maintain its rate Thursday, it would mirror policy by the US Federal Reserve, which says it is not yet ready to cut, but it would contrast with the European Central Bank and other central banks that have started to reduce borrowing costs. The SNB on Thursday lowered its rate by 0.25 percentage points to 1.25 percent, while Norway’s central bank left borrowing costs at 4.5 percent.

burs-bcp/rfj/lth

© 2024 AFP