Hong Kong (AFP) – Equity markets limped into the weekend on Friday following a tepid lead from Wall Street as the optimism stoked by a dovish US Federal Reserve meeting gave way to long-running fears about Donald Trump’s tariff agenda. Traders took heart from Fed boss Jerome Powell’s comments that the impact of hefty levies imposed on imports from key partners would likely be transitional, and from officials’ forecasts that did not see a feared recession this year.

That came days after China unveiled a range of measures aimed at boosting consumer spending and reigniting the world’s number two economy. However, the US president’s hardball trade policies continue to cast a dark shadow, keeping sentiment and appetite for risk in check. With central bank meetings in the United States, Japan, Britain, and Sweden passing with little major news and no movement on monetary policy, the main focus is back on tariffs, with the next wave of measures due to kick in at the start of April.

The uncertainty surrounding US policy — with the White House imposing, delaying, and then reimposing levies at the drop of a hat — has left traders with little choice but to take a step back. “Equity investors are back focusing on the uncertainty and negative impact that is likely to come from a trade war,” said National Australia Bank’s Rodrigo Catril. “Sentiment remains fragile with investors nervous and not sure whether to put on risk or take it off.” Tariff uncertainty, as we await the release of the America First Trade Report due on 2 April, remains the big dark cloud.

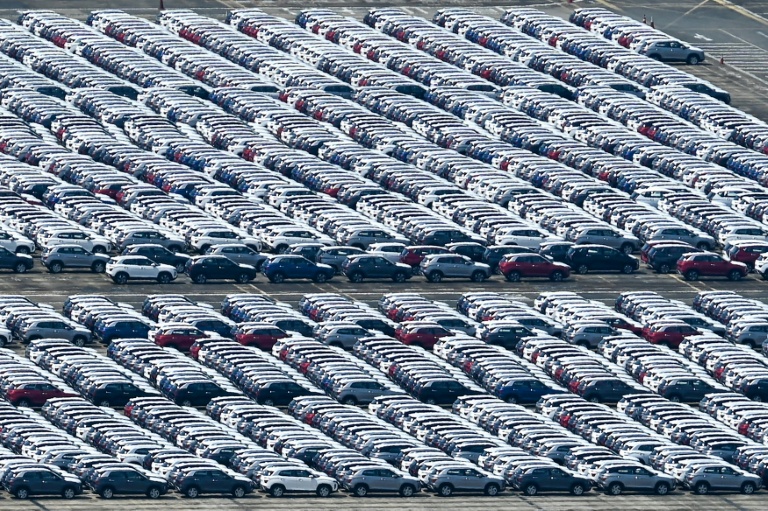

Shares in Hong Kong sank for a second successive day after a blistering start to the year, with Chinese electric vehicle maker BYD diving more than eight percent following a report that the European Commission was conducting a foreign subsidy investigation into its plant in Hungary. Tokyo, Shanghai, Singapore, Taipei, and Manila were in negative territory, with Jakarta down more than one percent to resume a 2025 sell-off fueled by worries about Indonesia’s economy. Sydney, Seoul, Mumbai, Bangkok, and Wellington edged up, while London, Paris, and Frankfurt dropped at the open.

Unease about the outlook continues to push gold prices higher as investors seek a safe haven from the volatility. The precious metal on Friday was sitting just below the record $3,057.49 per ounce touched on Thursday. Oil prices were also on the way up owing to rising geopolitical tensions as Israel ramps up attacks in Gaza and US forces strike Iran-backed Huthi rebels in Yemen. News that Washington had sanctioned a China-based oil refinery that purchased Iranian oil worth around $500 million from Huthi-linked ships added to trader concerns. Trump has resumed his campaign of “maximum pressure” against Tehran since returning to office and has already rolled out sanctions against several individuals and entities, including Iran’s oil minister.

– Key figures around 0815 GMT –

Tokyo – Nikkei 225: DOWN 0.2 percent at 37,677.06 (close)

Hong Kong – Hang Seng Index: DOWN 2.2 percent at 23,689.72 (close)

Shanghai – Composite: DOWN 1.3 percent at 3,364.83 (close)

London – FTSE 100: DOWN 0.2 percent at 8,686.33

Euro/dollar: DOWN at $1.0840 from $1.0856 on Thursday

Pound/dollar: DOWN at $1.2936 from $1.2967

Dollar/yen: UP at 149.28 yen from 148.76 yen

Euro/pound: UP at 83.79 pence from 83.72 pence

West Texas Intermediate: UP 0.1 percent at $68.16 per barrel

Brent North Sea Crude: UP 0.1 percent at $72.07 per barrel

New York – Dow: FLAT at 41,953.32 (close)

© 2024 AFP