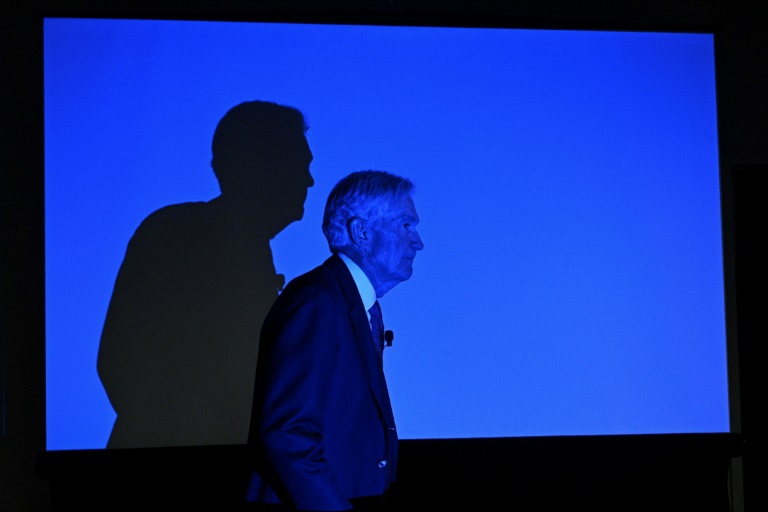

London (AFP) – Asian and European stock markets rose Thursday following more record-highs on Wall Street as Federal Reserve boss Jerome Powell hinted at a September cut to US interest rates.

On a second day of testimony to lawmakers, Powell said decision-makers would not wait until inflation had hit the bank’s two percent target before loosening monetary policy, adding: “If you waited that long, you’ve probably waited too long.”

That weighed on the dollar, while official data showing Britain’s economy has grown faster than thought boosted the pound, with analysts saying it could force the Bank of England to delay cutting interest rates until September.

In the US, Powell’s remarks came before Thursday’s update of the US consumer price index, which is expected to show a further slowdown.

“Investors have been putting their chips on the table and betting on inflation’s path ahead of today’s CPI print,” noted Matt Britzman, senior equity analyst at Hargreaves Lansdown.

Traders ramped up bets on the Fed reducing borrowing costs in two months’ time, with analysts saying Powell was telegraphing to markets that the decision had been made.

The comments soothed recent fears among investors that officials might keep rates at their two-decade high for some time owing to a still strong labour market and inflation staying stubbornly above two percent.

The S&P 500 ended with a sixth straight record Wednesday, while the Nasdaq also finished at an all-time peak.

The upbeat mood filtered through to Asia Thursday, where Hong Kong stocks jumped two percent and Tokyo, Shanghai and Sydney all rose.

London stocks gained and the pound hit a four-month high against the dollar, also as official data showed the UK economy grew last month at a faster pace than expected.

Paris and Frankfurt also advanced.

Eyes are also turning to the start of China’s Third Plenum gathering on Monday, where top officials including President Xi Jinping are expected to discuss ways to kickstart the world’s number two economy in the face of an ongoing property crisis and geopolitical issues.

However, while there is hope for some sort of major policy announcement, commentators remain cautious.

Andrew Batson, of Beijing-based consultancy Gavekal Dragonomics, told AFP he did not expect a “fundamental departure from the course Xi has already laid out”, in which technological self-sufficiency and national security outweigh economic growth.

Nomura’s Ting Lu added that the meeting was “intended to generate and discuss big, long-term ideas and structural reforms instead of making short-term policy adjustments”.

Economic growth in the first quarter of the year came in above forecasts and is tipped to top the government’s five percent goal for April-June, but the meeting comes amid ongoing concerns that officials are not providing enough support.

Taylor Nugent at National Australia Bank warned: “Further monetary policy easing is constrained by a reluctance to allow further depreciation in the renminbi, and expectations are low for any big policy shift at the Third Plenum.”

– Key figures around 1100 GMT –

London – FTSE 100: UP 0.2 percent at 8,213.57 points

Paris – CAC 40: UP 0.3 percent at 7,598.10

Frankfurt – DAX: UP 0.2 percent at 18,436.73

EURO STOXX 50: UP 0.3 percent at 4,974.62

Tokyo – Nikkei 225: UP 0.9 percent at 42,224.02 (close)

Hong Kong – Hang Seng Index: UP 2.1 percent at 17,832.33 (close)

Shanghai – Composite: UP 1.1 percent at 2,970.39 (close)

New York – Dow: UP 1.1 percent at 39,721.36 (close)

Pound/dollar: UP at $1.2877 from $1.2848 on Wednesday

Euro/dollar: UP at $1.0850 from $1.0833

Dollar/yen: DOWN at 161.54 yen from 161.71 yen

Euro/pound: DOWN at 84.27 pence from 84.29 pence

Brent North Sea Crude: UP 0.4 percent at $85.42 per barrel

West Texas Intermediate: UP 0.3 percent at $82.31 per barrel

© 2024 AFP