London (AFP) – The Bank of England on Thursday halved its forecast for UK economic growth this year, blaming global risks amid US tariff threats and deteriorating business confidence in the UK. The sharp downgrade, which estimates gross domestic product at 0.75 percent in 2025 compared with a forecast of 1.5 percent in November, came alongside a BoE cut to its key interest rate.

In an expected decision, the central bank trimmed borrowing costs by a quarter point to 4.5 percent at a regular policy meeting, with weak growth concerns offsetting worries about above-target UK inflation. The British pound slid against the dollar and euro in reaction, but London’s top-tier FTSE 100 shares index traded at fresh record highs, helped by some of its biggest constituents’ earnings in dollars.

Downgrades to growth— the BoE also said the UK economy likely grew 0.75 percent last year rather than 1.0 percent—heaps more pressure on the Labour government, which has pledged to drive forward the economy since winning power in July. A third interest-rate cut in six months “is welcome news, helping ease the cost of living pressures…and making it easier for businesses to borrow to grow,” finance minister Rachel Reeves said in a statement. “However, I am still not satisfied with the growth rate.”

Only last month, the International Monetary Fund predicted the UK economy would expand by 1.6 percent this year, a boost for Prime Minister Keir Starmer.

**- Tariffs warning -**

BoE governor Andrew Bailey on Thursday said the central bank will be “monitoring the UK economy and global developments very closely and taking a gradual and careful approach to reducing rates further.” Some analysts said the next cut could come as soon as March rather than May, as had been widely expected ahead of the latest decision. At 4.5 percent, British borrowing costs are at the lowest level since June 2023.

Seven BoE policymakers, including Bailey, voted for a quarter-point cut, but the remaining two wanted a deeper reduction to 4.25 percent. “GDP growth has been weaker than expected…and indicators of business and consumer confidence have declined,” minutes of the meeting said. “Tariffs and other trade barriers would likely have adverse effects on UK activity,” the BoE added.

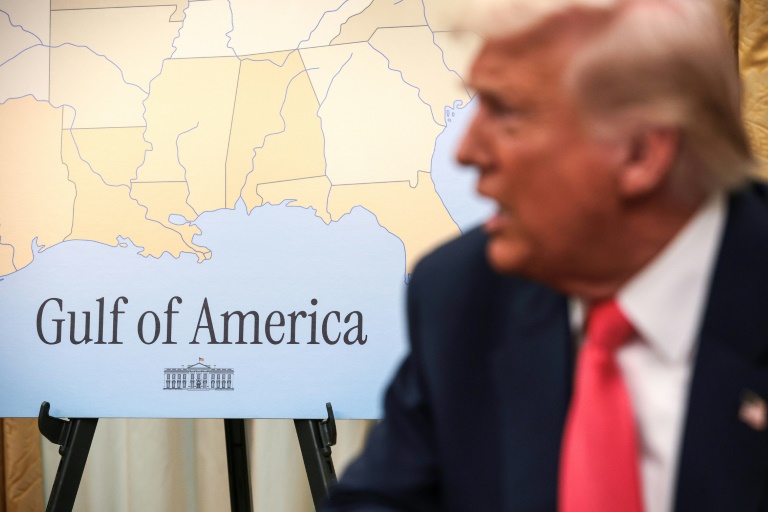

Trump has stated that Britain may not escape levies on its exports to the United States, having already imposed tariffs on imports from China and threatened similar action against the European Union. The president has delayed measures against US neighbours Mexico and Canada, pending talks.

**- Inflation risk -**

There is widespread concern that such tariffs will cause a renewed spike in inflation that risks hikes to interest rates. The BoE added Thursday that UK inflation would rise more than expected this year, having fallen in December but remaining above the BoE target of 2.0 percent. The US Federal Reserve last week left borrowing costs unchanged, but the European Central Bank cut eurozone rates.

The Bank of England reduced its main rate in August for the first time since early 2020, from a 16-year high of 5.25 percent after UK inflation fell sharply. It trimmed further in November, aiding mortgage borrowers but hurting savers as retail banks tend to pass on similar cuts to customers.

Major central banks last year began to cut interest rates that had been hiked in efforts to tame runaway price rises. UK inflation had soared to above 11 percent in October 2022, the highest level in more than four decades, as the Russia-Ukraine war cut energy and food supplies. Companies faced supply constraints also as they struggled to return to the pre-Covid rhythm of working.

© 2024 AFP