New York (AFP) – US aircraft manufacturer Boeing unveiled measures meant to replenish its cash flow Tuesday, including an intention to raise up to $25 billion, as it navigates recurrent production problems and a major US strike. In a regulatory filing, the aviation giant indicated plans to raise the funds by selling stock and debt. It also earlier announced that it was in an agreement to obtain $10 billion in credit from multiple banks.

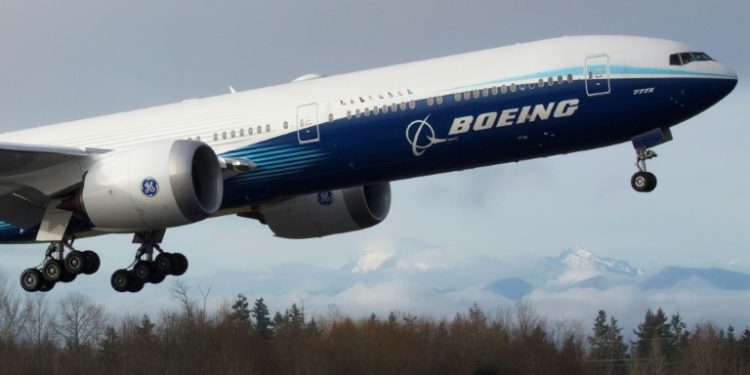

The moves come amid a machinist strike in the Seattle region which effectively shut down assembly plants for the 737 MAX and 777. About 33,000 Boeing workers in the Pacific Northwest have been on strike for nearly a month in a fight focused on higher wages and improved retirement benefits. Workers complain of more than a decade of near-flat wages during a period when inflation has risen.

Boeing staff with the International Association of Machinists and Aerospace Workers (IAM) walked off the job on September 13 after overwhelmingly rejecting a contract offer. The direct financial impact of the first month of the strike cost Boeing more than $3 billion, according to Anderson Economic Group. Following the latest announcement, Boeing shares climbed 2.3 percent to end Tuesday.

The IAM said in a statement last week that it is “ready and willing to resume negotiations at any time.” But it added Monday: “While it is important to return to the table, the Union remains firm on securing an agreement that truly reflects the respect our members have earned and deserve.” Last week, Boeing said it planned to cut 10 percent of its workforce as it projected a large third-quarter loss in the wake of the labor action.

The cuts of 17,000 positions globally will include executives, managers, and employees, according to Chief Executive Kelly Ortberg, who added that the company must “reset our workforce levels to align with our financial reality.” Details of the cuts were expected to come this week.

The work stoppage has only added to the company’s litany of problems. As a result of the strike, Boeing has said it is pushing back the first delivery of the 777X to 2026 from 2025. The much-delayed jet was originally supposed to enter service in January 2020.

Boeing sank into further turmoil in January when a panel blew out mid-flight on an Alaska Airlines plane, necessitating an emergency landing on a 737 MAX, the aircraft involved in two fatal crashes in 2018 and 2019. That led to the Federal Aviation Administration tightening oversight of Boeing’s production processes, capping the company’s output. Production on the MAX is now halted due to the IAM strike.

© 2024 AFP