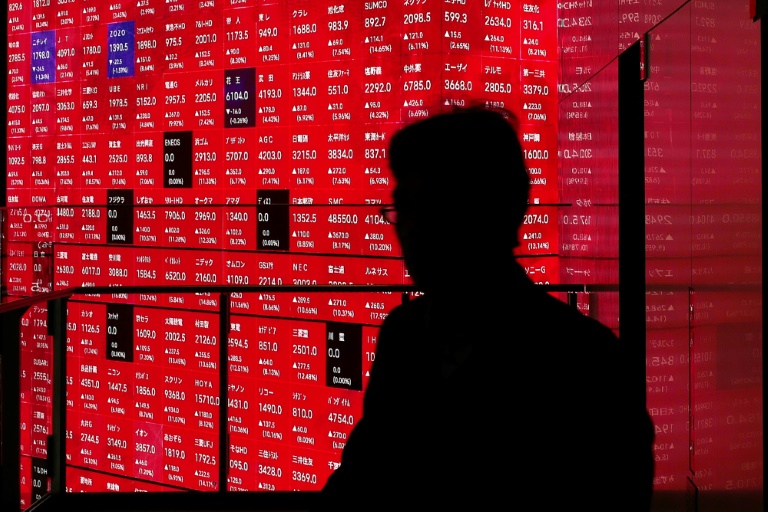

US and European stock markets mostly rose Thursday on the eve of key US data, while gold set another record peak on the back of geopolitical tensions and hopes of interest-rate cuts.

Markets were buoyed after US data released on Wednesday provided a fresh indicator that inflation was easing and Federal Reserve boss Jerome Powell soothed worries around the central bank’s plans to cut rates this year.

Wall Street’s main indices advanced in late morning trading.

In Europe, Frankfurt and London ticked higher and Paris ended the day flat, despite a mixed performance in Asia and with Hong Kong and Shanghai shut for holidays.

Gold struck another record peak at $2,304.96 per ounce in Asia, extending its blistering run before paring gains in Europe.

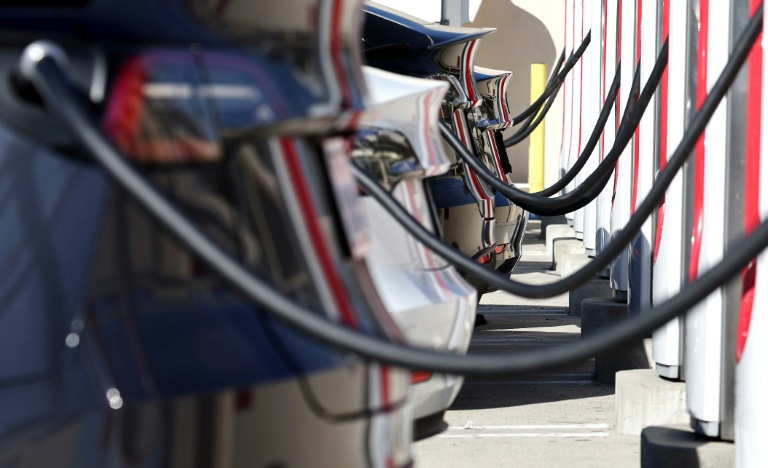

Oil sat near five-month peaks with the international benchmark contract, Brent, close to $90 per barrel, as traders tracked ongoing turmoil in the crude-rich Middle East, alongside a decision by OPEC+ to maintain its output-cutting strategy.

– ‘Soothing tones’ –

“The soothing tones of Jerome Powell…were enough for the markets to breathe a sigh of relief,” noted XTB analyst Kathleen Brooks.

“The Fed chair said that the Fed remained data dependent, but that the latest inflation figures should not stop the Fed from cutting interest rates.”

All eyes will now be on Friday’s upcoming non-farm payrolls report, a key indicator for the world’s biggest economy.

“Friday’s employment figures will shed further light on the state of the underlying US economy and could solidify traders’ expectations regarding the timing of the first Fed rate cut,” added ActivTrades analyst Ricardo Evangelista.

An equities rally that started at the back end of 2023 has stuttered in recent weeks after a string of reports suggested the US economy was too strong and prices too sticky for officials to begin easing monetary policy this year.

Warnings from decision-makers that they were worried about bringing down borrowing costs too soon have also played on investors’ minds, causing them to pare back expectations for how many rate cuts — if any — were coming before January.

But those concerns were allayed somewhat Wednesday when Powell said he still saw cuts coming this year.

He told a conference in California that rates, which are at a two-decade high, were doing their job but moving too soon could be “quite disruptive” for the world’s top economy.

But if the economy continues to evolve as expected, most Fed participants still anticipate it will be “appropriate to begin lowering the policy rate at some point this year”. Confidence among traders was given an extra lift by figures showing a slowdown in growth in the services sector and a sharp drop in input costs during March, suggesting an easing of inflation.

Weekly unemployment data released on Thursday showed a small uptick in initial claims to 221,000, while continuing claims dipped.

“The key takeaway from the report is the element of softening seen in the initial claims number,” said Patrick O’Hare at Briefing.com.

“However, initial claims continue to run well below levels associated with a truly weak labor market and a contracting economy,” he added.

The data contrasted with a stronger-than-expected reading of US manufacturing and prices paid earlier this week, which sparked questions about the Fed’s rate-cutting timeline.

– Key figures around 1530 GMT –

New York – Dow: UP 0.4 percent at 39,291.74 points

New York – S&P 500: UP 0.7 percent at 5,246.37

New York – Nasdaq Composite: UP 0.9 percent at 16,418.75

London – FTSE 100: UP 0.5 percent at 7,975.89 (close)

Paris – CAC 40: FLAT at 8,151.55 (close)

Frankfurt – DAX: UP 0.2 percent at 18,403.13 (close)

EURO STOXX 50: FLAT at 5,070.76 (close)

Tokyo – Nikkei 225: UP 0.8 percent at 39,773.14 (close)

Hong Kong – Hang Seng Index: Closed for holidays

Shanghai – Composite: Closed for holidays

Dollar/yen: DOWN at 151.68 yen from 151.70 yen on Wednesday

Euro/dollar: UP at $1.0863 from $1.0857

Pound/dollar: UP at $1.2668 from $1.2658

Euro/pound: UP at 85.78 pence from 85.76 pence

Brent North Sea Crude: DOWN 0.2 percent at $89.19 per barrel

West Texas Intermediate: DOWN 0.4 percent at $85.11 per barrel

© 2024 AFP