Washington (AFP) – US and European markets mostly rose Monday following a report — strongly denied by US President-elect Donald Trump — that his incoming administration was mulling applying tariffs more selectively than he had previously suggested. While the Dow fell on Wall Street, both the S&P 500 and the Nasdaq Composite closed higher, as investors plowed money into the semiconductor sector following strong results from Taiwan-based Foxconn. The rally helped spur chip designer Nvidia to a fresh record, giving the company a market valuation of more than $3.6 trillion. And shares of the streaming company Fubo surged by more than 251 percent after Disney announced it would be merging Fubo with the Hulu+ Live TV service. Disney’s shares closed down 0.1 percent.

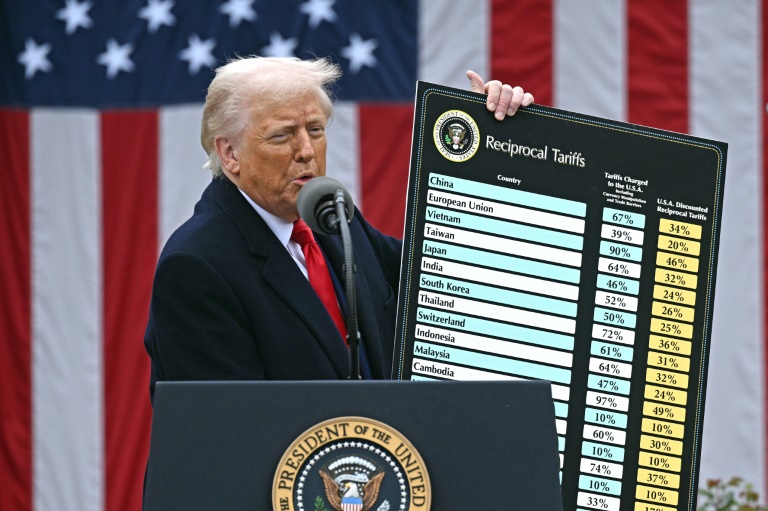

– Less painful tariffs? – Traders were also digesting a report in the Washington Post that Trump’s aides are weighing plans to only apply tariffs to goods in certain critical sectors — a more narrow definition than the president-elect previously proposed. Wall Street initially soared after Trump’s election victory on expectations of tax cuts and deregulation, but concerns about his tariff plans soon caught up with traders, raising concerns about their potential impact on inflation, interest rates, and economic growth. Trump hit back strongly against the report in a post to his Truth Social account on Monday. The story, he said, “incorrectly states that my tariff policy will be pared back. That is wrong.” “The Washington Post knows it’s wrong. It’s just another example of Fake News,” he added.

– Luxury gains – In Europe, Paris rose more than two percent thanks to gains in luxury stocks. “A Birkin bag, a bottle of Moet and Gucci shoes are hardly critical imports, which is why the luxury sector is having a strong reaction to this news,” said Kathleen Brooks, research director at the XTB trading platform. Beyond tariffs, there were also other factors driving sentiment in the markets. Briefing.com analyst Patrick O’Hare said there was “tax policy enthusiasm” as Trump pushes for the passage of legislation that would extend tax cuts from his first term in office.

The US dollar was broadly weaker on hopes of a more limited US tariff policy; it also dropped 0.5 percent against its Canadian counterpart after Canada’s Prime Minister Justin Trudeau announced he would step down as the leader of his political party. Trudeau’s popularity has waned in recent months, with his government narrowly surviving a series of no-confidence votes and critics calling for his resignation. He faced further pressure from Trump, who has threatened a 25-percent tariff on Canadian goods after he takes office on January 20.

In Asia, the Seoul stock market rose 1.9 percent Monday despite the ongoing political uncertainty, while Tokyo retreated, with Nippon Steel taking a hit after departing US President Joe Biden blocked its proposed $14.9 billion purchase of US Steel.

– Key figures around 2200 GMT –

New York – Dow: DOWN 0.1 percent at 42,706.56 points (close)

New York – S&P 500: UP 0.6 percent at 5,975.38 (close)

New York – Nasdaq Composite: UP 1.2 percent at 19,864.98 (close)

London – FTSE 100: UP 0.3 percent at 8,249.66 (close)

Paris – CAC 40: UP 2.2 percent at 7,445.69 (close)

Frankfurt – DAX: UP 1.6 percent at 20,216.19 (close)

Tokyo – Nikkei 225: DOWN 1.5 percent at 39,307.05 (close)

Hong Kong – Hang Seng Index: DOWN 0.4 percent at 19,688.29 (close)

Shanghai – Composite: DOWN 0.1 percent at 3,206.92 (close)

Euro/dollar: UP at $1.0388 from $1.0307 on Friday

Pound/dollar: UP at $1.2518 from $1.2423

Dollar/yen: UP at 157.64 yen from 157.33 yen

Euro/pound: UP at 82.98 pence from 82.95 pence

West Texas Intermediate: DOWN 0.5 percent at $73.56 per barrel

Brent North Sea Crude: DOWN 0.3 percent at $76.30 per barrel

burs-rl-da/aha

© 2024 AFP