Washington (AFP) – The US Federal Reserve’s preferred inflation measure accelerated for a third month in a row in December, according to government data published Friday, while underlying inflation was unchanged. The personal consumption expenditures (PCE) price index rose 2.6 percent in the 12 months to December, up from 2.4 percent in November, the Commerce Department said in a statement. Inflation rose 0.3 percent from a month earlier. This was in line with the median forecasts from economists surveyed by Dow Jones Newswires and The Wall Street Journal.

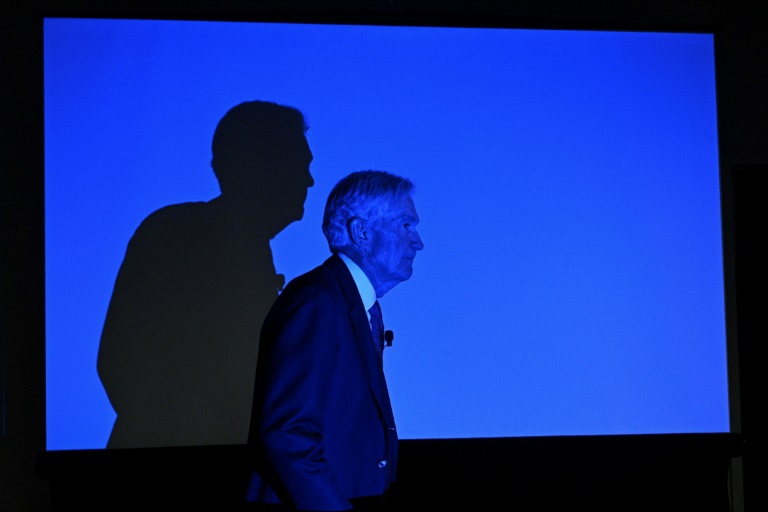

Stripping out volatile food and energy costs, the so-called core index rose by 0.2 percent from a month earlier, and by 2.8 percent from a year ago. “I’m liking this PCE number,” Chicago Fed president Austan Goolsbee told CNBC in an interview. “It was expected, and it was even a little better than expected.” “The report showed slightly higher inflation, but it was in line with expectations, meaning it won’t disrupt the narrative of a potential Fed rate cut in the first half of the year,” Jochen Stanzl, Chief Market Analyst at CMC Markets wrote in a note to clients.

Personal saving as a percentage of disposable personal income eased slightly to 3.8 percent in December from 4.1 percent in November, the Commerce Department said, indicating that consumers saved less of the money they earned last month.

Moving away from 2% – Headline inflation has been moving away from the Fed’s long-term target of two percent since September, causing issues for policymakers at the US central bank. The Fed has a dual mandate to tackle inflation and unemployment, and does so mainly by raising and lowering short-term lending rates, which then trickle through into consumer and producer borrowing costs.

On Wednesday, the Fed voted unanimously to pause rate reductions following three consecutive cuts, holding the bank’s benchmark lending rate at between 4.25 and 4.50 percent. While headline inflation has accelerated, economic growth has been strong, and the labor market has remained resilient, with the unemployment rate ticking down to 4.1 percent last month. “There’s still more work to be done to bring inflation closer to our two percent goal,” Fed governor Michelle Bowman told a conference in New Hampshire on Friday. “I would like to see progress in lowering inflation resume before we make further adjustments to the target range,” added Bowman, who is a permanent voting member of the Fed’s rate-setting Federal Open Market Committee (FOMC).

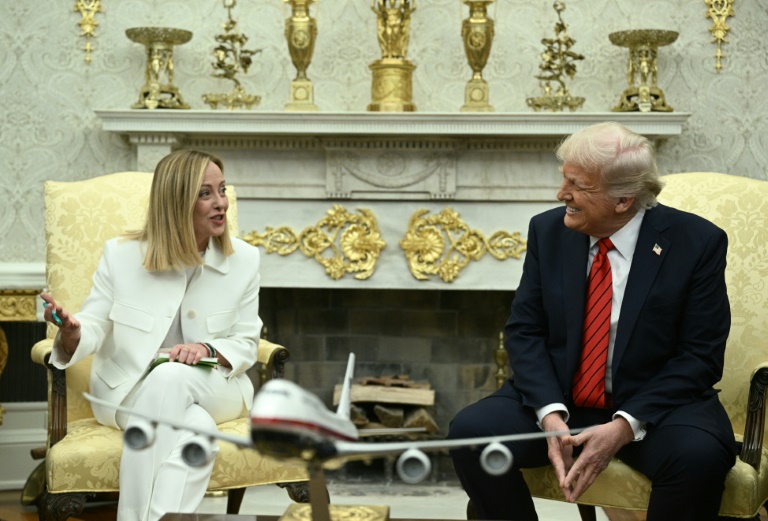

One potential spanner in the works of the Fed’s inflationary fight is President Donald Trump’s threats to introduce new tariffs on several US trading partners, which could come into effect as soon as this weekend. “We’ve got a lot of policy uncertainty,” said Goolsbee from the Chicago Fed, noting that he was not weighing in on what policies he expected the US president — or Congress — to enact. “If it affects prices, it affects us,” he continued, adding that the Fed’s signals became “muddied” when things happened that drove up prices.

© 2024 AFP