New York (AFP) – Global equities mostly rose Tuesday despite lackluster consumer confidence data in the United States and Germany, as the tech-linked Nasdaq pushed higher.

The Conference Board reported a bigger than expected drop in US consumer confidence in February, as survey participants expressed more concern about the labor market and the American political environment.

The outlook was also subdued in Germany.

Although income expectations rose following wage hikes across different sectors, shoppers remained pessimistic about the German economy and their propensity to make large purchases was largely unchanged from a month ago, pollster GfK said in a statement.

“Consumers are feeling very uncertain,” NIM consumer expert Rolf Buerkl said, blaming still-elevated inflation and “weaker economic forecasts for the German economy this year.”

Wall Street stocks were mixed, with the Dow falling but the S&P 500 and Nasdaq advancing.

Analysts have identified an inclination for tech shares to bounce following a retreat as bargain hunters step in.

But US markets are pricing in fewer Federal Reserve interest rate cuts in 2024, noted Goldman Sachs Chief Executive David Solomon, who told a financial conference that a recession was still possible.

“The market is way weighted to a very soft landing,” Solomon said.

“And when you look at the pattern effects for the last three or four years, it’s hard for me to see it’s going to be that simple.”

In Europe, both Frankfurt and Paris advanced while London edged lower. “The economic outlook for Europe is for stagnant growth this year, however, its biggest companies are global powerhouses,” said Kathleen Brooks, research director at XTB.

“We may continue to see a strong performance of the European index in the coming months.”

Among individual companies, Macy’s jumped 3.4 percent as it announced plans to close 150 “underproductive” locations in an effort to jumpstart profits.

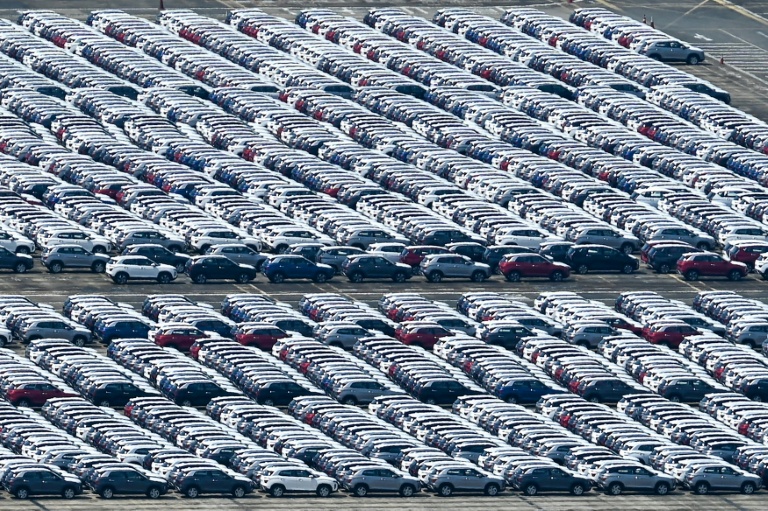

Apple rose 0.8 percent following a Bloomberg report that the tech giant canceled its electric vehicle research and is steering funds instead to artificial intelligence.

– Key figures around 2130 GMT –

New York – Dow: DOWN 0.3 percent at 38,972.41 (close)

New York – S&P 500: UP 0.2 percent at 5,078.18 (close)

New York – Nasdaq: UP 0.4 percent at 16,035.30 (close)

London – FTSE 100: DOWN less than 0.1 percent at 7,683.02 (close)

Paris – CAC 40: UP 0.2 percent at 7,948.40 (close)

Frankfurt – DAX: UP 0.8 percent at 17,556.49 (close)

EURO STOXX 50: UP 0.4 percent at 4,885.74 (close)

Tokyo – Nikkei 225: FLAT at 39,239.52 (close)

Hong Kong – Hang Seng Index: UP 0.9 percent at 16,790.80 (close)

Shanghai – Composite: UP 1.3 percent at 3,015.48 (close)

Euro/dollar: DOWN at $1.0850 from $1.0851 on day

Dollar/yen: DOWN at 150.49 yen from 150.70 yen

Pound/dollar: UP at $1.2685 from $1.2678

Euro/pound: DOWN at 85.49 pence from 85.59 pence

Brent North Sea Crude: UP 1.4 percent at $83.65 per barrel

West Texas Intermediate: UP 1.7 percent at $78.87 per barrel

burs-jmb/st