In the realm of economics, few phenomena are as impactful and widely studied as inflation and recession. Both have the potential to disrupt economies, affect livelihoods, and shape the course of nations. Understanding the causes, impacts, and mechanisms for controlling inflation and recession is crucial for policymakers, economists, and individuals alike.

What is Inflation?

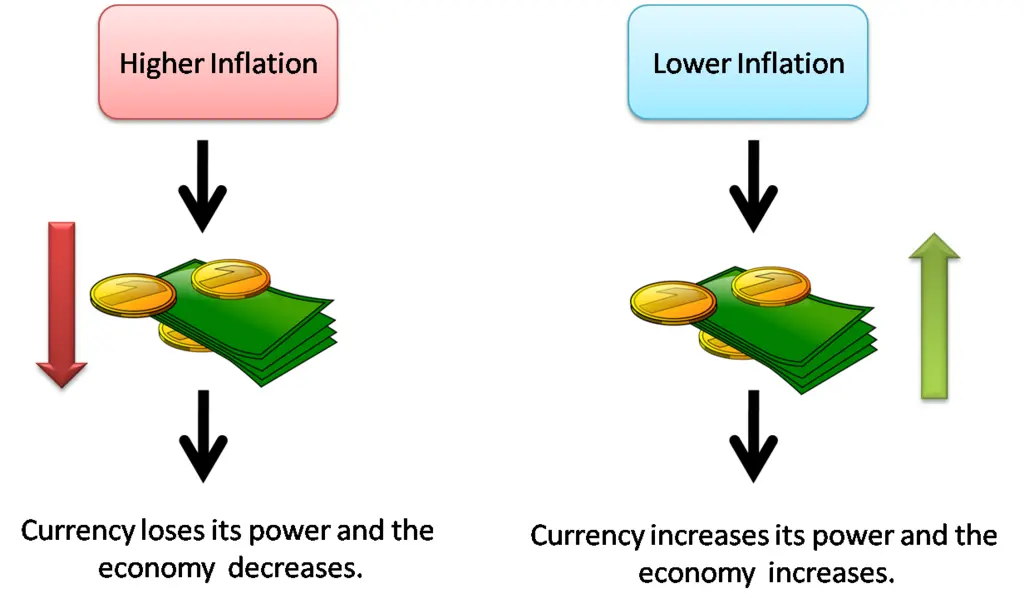

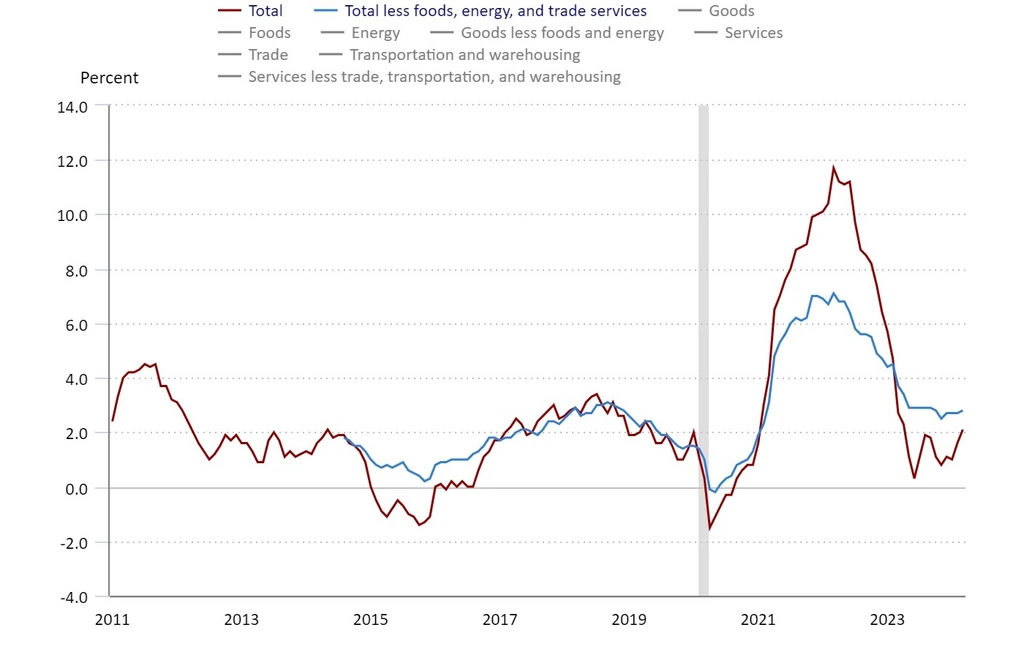

Inflation refers to the sustained increase in the general price level of goods and services in an economy over a period of time. This means that the purchasing power of money decreases, leading to a decrease in the real value of money. Inflation can be caused by various factors, including increased demand, rising production costs, expansionary monetary policies, and external shocks such as changes in oil prices or exchange rates.

Impact of Inflation

The impact of inflation can be both positive and negative, depending on the extent and speed of its rise. Moderate inflation is often seen as a sign of a healthy economy, as it indicates rising consumer demand and economic growth. However, high or hyperinflation can have detrimental effects, including:

- Reduced purchasing power: As the cost of goods and services rises, consumers can buy fewer goods with the same amount of money, leading to a decrease in their standard of living.

- Uncertainty: High inflation rates can lead to uncertainty among businesses and consumers, making it difficult to plan for the future and allocate resources effectively.

- Income redistribution: Inflation can redistribute income from savers to borrowers, as the real value of savings decreases while debts remain constant or decrease in real terms.

- International competitiveness: High inflation can erode a country’s international competitiveness by increasing the cost of exports and reducing the attractiveness of domestic goods and services to foreign buyers.

What is a Recession?

A recession is defined as a significant decline in economic activity across the economy, lasting for a prolonged period of time. It is typically characterized by a contraction in GDP, rising unemployment, falling consumer spending, and declining business investment. Recessions can be caused by various factors, including:

- Demand-side shocks: Such as a decrease in consumer confidence, leading to reduced spending and investment.

- Supply-side shocks: Such as natural disasters or disruptions in the supply chain, leading to decreased production and output.

- Monetary policy: Tightening of monetary policy by central banks to control inflation can lead to higher interest rates, reduced borrowing, and decreased economic activity.

Impact of Recession

The impact of a recession can be severe and far-reaching, affecting individuals, businesses, and governments alike. Some of the key consequences of a recession include:

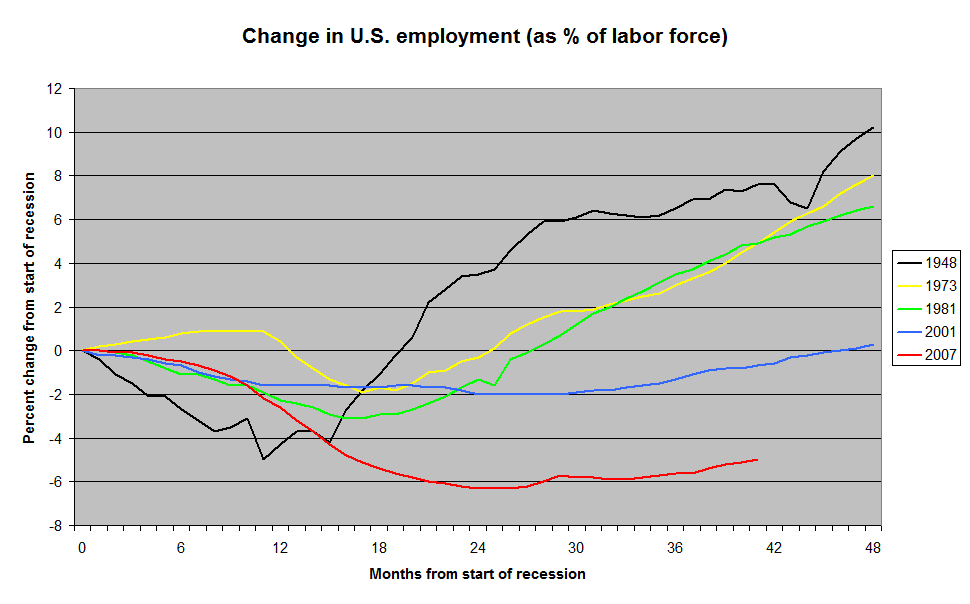

- Unemployment: One of the most visible and immediate effects of a recession is a rise in unemployment as businesses cut costs and reduce their workforce.

- Reduced consumer spending: Falling consumer confidence and income uncertainty during a recession can lead to decreased consumer spending, further exacerbating the economic downturn.

- Decline in business investment: Businesses may delay or cancel investment projects during a recession due to uncertainty and reduced demand, leading to a decline in productivity and economic growth.

- Government finances: A recession can strain government finances as tax revenues decrease and social welfare spending increases, leading to higher budget deficits and public debt.

Control Mechanism for Inflation and Recession

Central banks and governments employ various tools and policies to control inflation and mitigate the effects of recessions. Some of the key mechanisms include:

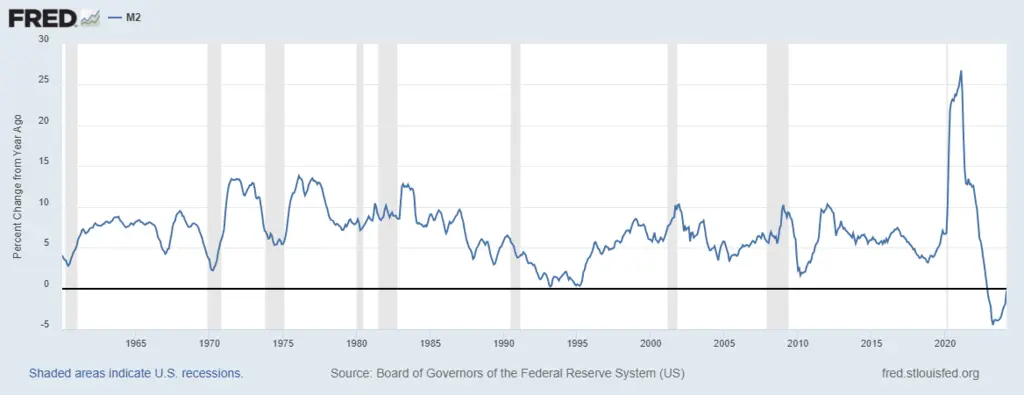

- Monetary policy: Central banks use monetary policy tools such as interest rates, reserve requirements, and open market operations to influence the money supply and control inflation. During periods of recession, central banks may lower interest rates and engage in quantitative easing to stimulate economic activity.

- Fiscal policy: Governments can use fiscal policy measures such as taxation and government spending to stabilize the economy during recessions. For example, increased government spending on infrastructure projects can create jobs and stimulate demand, helping to lift the economy out of a recession.

- Supply-side policies: Governments can implement supply-side policies aimed at increasing productivity, promoting competition, and reducing regulatory burdens. These policies can help to address underlying structural issues in the economy and improve its long-term growth potential.

- Automatic stabilizers: Certain government programs, such as unemployment insurance and welfare benefits, act as automatic stabilizers during economic downturns by providing support to individuals and families facing financial hardship.

In conclusion, inflation and recession are two of the most significant challenges facing economies around the world. While they can have profound and often adverse effects on individuals and societies, effective policy responses and control mechanisms can help to mitigate their impact and promote sustainable economic growth. By understanding the causes, impacts, and mechanisms for controlling inflation and recession, policymakers and individuals can better navigate the complexities of the economic landscape and work towards a more stable and prosperous future.