Paris (AFP) – A global stock market rout deepened on Monday and fears of recession rose after China retaliated against US President Donald Trump’s tariffs and Europe calibrated its response to the escalating trade war. European equities were deep in the red but Asia fared worse, with Hong Kong’s Hang Seng index crashing 13.2 percent, its biggest drop since the 1997 Asian financial crisis, and Tokyo’s Nikkei 225 falling an eye-watering 7.8 percent.

A 10-percent “baseline” tariff on imports from around the world took effect on Saturday, but a slew of countries will be hit by higher duties from Wednesday, with levies of 34 percent for Chinese goods and 20 percent for EU products. While other countries weigh their options, Beijing announced last week its own 34-percent tariff on US goods, which will come into effect on Thursday. The tit-for-tat duties “are aimed at bringing the United States back onto the right track of the multilateral trade system,” Chinese vice commerce minister Ling Ji said. “The root cause of the tariff issue lies in the United States,” Ling told representatives of US companies on Sunday, according to his ministry.

EU trade ministers gathered in Luxembourg on Monday to discuss the bloc’s response, with Germany and France having advocated a tax targeting US tech giants. “We must not exclude any option on goods, on services,” said French Trade Minister Laurent Saint-Martin. The 27-nation bloc should “open the European toolbox, which is very comprehensive and can also be extremely aggressive,” he said. German Economy Minister Robert Habeck likewise said Europe should be prepared to use its trade “bazooka” — a new anti-coercion mechanism allowing it to punish any country using economic threats to exert pressure on the EU. But signs of divergence already emerged, with Ireland, whose low corporate tax rate has attracted US tech and pharmaceutical companies, warning against that course of action. Targeting services “would be an extraordinary escalation at a time when we must be working for de-escalation,” said Irish Trade Minister Simon Harris. EU trade chief Maros Sefcovic said Europe was facing a “paradigm shift of the global trading system.”

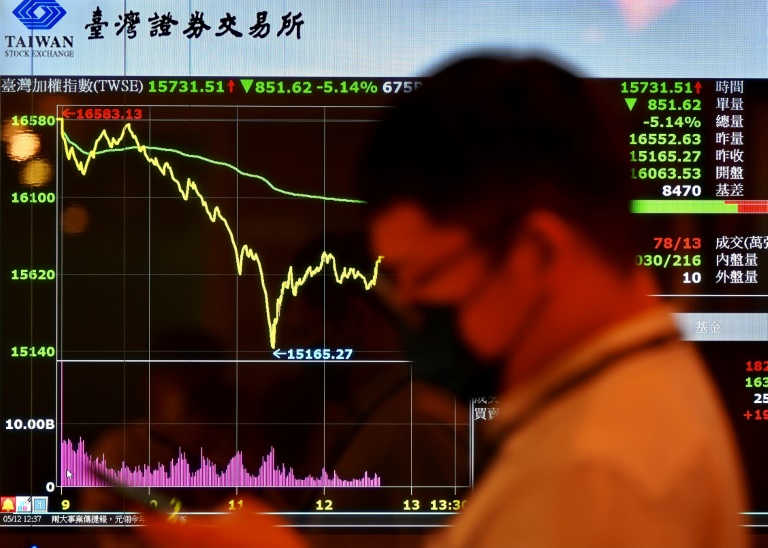

Recession fears escalated as Trump on Sunday doubled down on his demand to slash deficits with trading partners, saying he would not cut any deals unless that was resolved. “Sometimes you have to take medicine to fix something,” said Trump, whose administration has shrugged off the market panic. He told reporters aboard Air Force One that world leaders were “dying to make a deal.” Trillions of dollars have been wiped off stocks worldwide since Trump announced the tariffs last week, and the losses deepened on Monday. Taipei recorded its heaviest loss on record as it sank 9.7 percent. In Europe, Frankfurt’s DAX sank as much as 10 percent in early deals but the German index pared back losses and was down just under four percent shortly after midday, with similar losses in Paris and London. US markets were expected to open deep in the red later on Monday. The main US oil contract dropped below $60 a barrel for the first time since April 2021 on worries of a global recession. “The market’s telling you in plain language: global demand is vanishing, and a global recession is on the cards and coming on fast,” said Stephen Innes at SPI Asset Management.

US officials said more than 50 countries have reached out to Trump to negotiate. Japanese Prime Minister Shigeru Ishiba, whose country faces a 24-percent levy, said Tokyo would present Trump with a “package” of measures to win relief from US tariffs ahead of a mooted call between the leaders. Benjamin Netanyahu, prime minister of Israel — hit with 17 percent tariffs, despite being one of Washington’s closest allies — was due on Monday to become the first leader to meet Trump since last week’s announcement. British Prime Minister Keir Starmer warned in a newspaper op-ed that “the world as we knew it has gone,” saying the status quo would increasingly hinge on “deals and alliances.” Vietnam, a manufacturing powerhouse with a big trade surplus with the United States, has already reached out and requested a delay of at least 45 days to thumping 46-percent tariffs. US Treasury Secretary Scott Bessent told NBC’s Meet the Press that Trump has “created maximum leverage for himself.” “I think we’re going to have to see what the countries offer and whether it’s believable,” Bessent said. Other countries have been “bad actors for a long time and it’s not the kind of thing you can negotiate away in days or weeks,” he said.

© 2024 AFP