Paris (AFP) – Renault confirmed on Thursday it defied headwinds in the car industry by boosting revenue and attaining record profitability in 2024 thanks to the success of its new line-up of vehicles. However, net profit sank as it scaled back its partnership with Nissan. The group, which also includes the budget Dacia brand and sportscar Alpine, saw revenues rising by 7.4 percent to hit 56.2 billion euros ($58.6 billion), with its operating profit margin coming in at a record 7.6 percent.

Despite this growth, net profit sank to 800 million euros due to a 1.5-billion-euro loss booked on the sale of Nissan shares. Without the sale of Nissan shares, profit would have come in at 2.8 billion euros, a 21 percent increase on 2023. The board proposed a dividend payment of 2.20 euros per share, an increase of 19 percent from last year. The company’s shares slid around one percent in late morning trading on the Paris stock exchange.

Chief executive Luca de Meo welcomed the strong results, which have contrasted sharply with Renault’s European rivals that have been buffeted by a slowdown in sales in China and a bumpy transition to electric vehicles. “It’s clear that we’ve turned Renault Group into, I think, a very nimble, effective and efficient machine fit for navigating today’s stormy waters,” he told a meeting of analysts. “I think I can say… we found our magic potion, like in Asterix and Obelix,” he added.

That magic potion is Renault’s new line-up of vehicles; it launched 10 models in 2024, including new versions of the Scenic and Dacia Duster. In total, it has launched 22 vehicles in the past three years. Chief financial officer Thierry Pieton told journalists that the automaker’s “excellent performance is the result of our product offensive and cost-cutting.” “Renault Group has never been so strong and benefited from such solid fundamentals,” he added.

New vehicles accounted for 24 percent of sales in the final quarter of 2024, which is a good indication for the start of 2025, said Pieton.

The company’s new compact Renault 5 electric car has booked orders at a higher rate than expected in Europe, where it is available. Pieton said the Renault 5, which harks back to a popular model from the 1970s through the 1990s, was bringing clients into dealerships and had a “halo effect” on sales of other models. Electric models still represent only nine percent of Renault’s sales in Europe, however, where hybrids are currently the favorite of consumers. Renault is in second place behind Toyota in terms of hybrid sales.

De Meo announced that Dacia will launch a small electric car manufactured in Europe, which will retail for under 18,000 euros before incentives. The carmaker enjoyed certain success with its budget subcompact electric car Spring, but the fact that it is manufactured in China means it is subject to European import tariffs, harming its competitiveness in the market. Renault has big hopes for its subcompact Twingo to hit the market this year to help make the price of electric cars more affordable. The car, designed in China but assembled in Slovenia, is part of Renault’s efforts to speed up the development time of vehicles to less than two years.

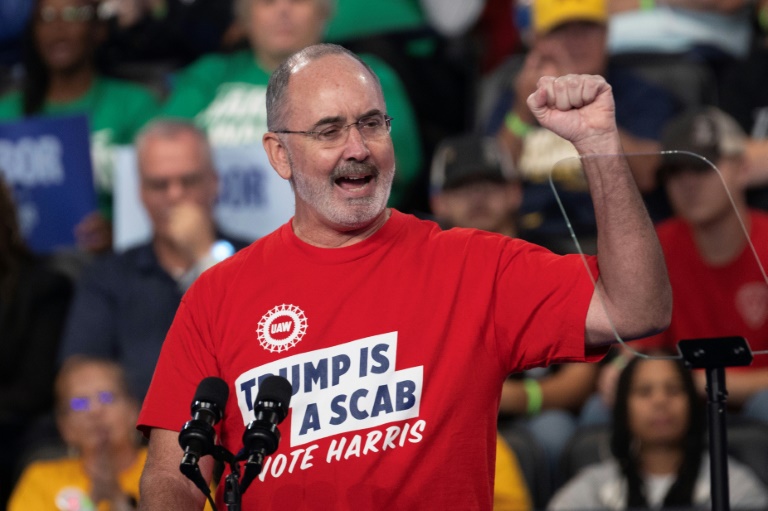

Pieton mentioned that Renault wasn’t keen on joining up with other carmakers to meet emissions requirements and expressed hope the regulations would be relaxed. Tighter emissions regulations this year could cost the company about one percentage point of revenue in 2025, around 550 million euros, it estimates, as it cuts prices on electric models to meet sales targets.

However, de Meo stated that Renault would continue and accelerate its partnerships with other firms to cut costs and expand into related markets. He announced a new strategic plan called Futurama to reinvest profits into technological innovation. “I think we are in a moment of technological discontinuities, and it gives us a once-in-a-century opportunity to put Renault Group in the Champions League of car making,” said de Meo.

© 2024 AFP