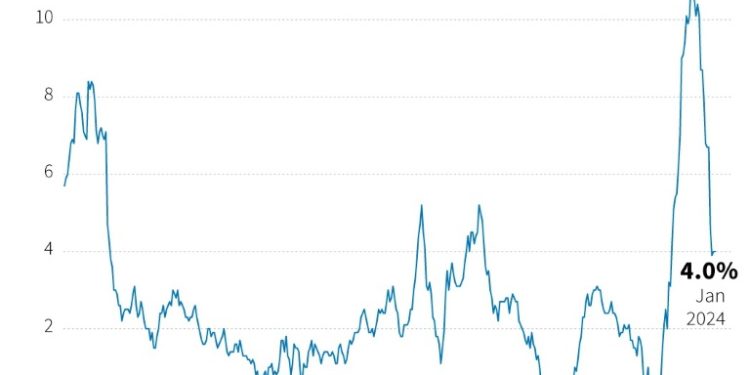

London (AFP) – British annual inflation steadied last month, official data showed Wednesday, but prices still rose at double the Bank of England’s target rate, adding to uncertainty over the timing of an interest-rate cut.

The Consumer Prices Index was unchanged at 4.0 percent in January from December, when it had surprisingly picked up, the Office for National Statistics (ONS) said in a statement.

The January reading was better than market expectations of an increase to 4.2 percent, but inflation nevertheless remains elevated, extending a cost-of-living crisis for millions of people in Britain.

The Bank of England’s main interest rate sits at a 16-year high of 5.25 percent, with high inflation preventing cuts to borrowing costs.

The latest inflation data comes before critical economic growth figures due Thursday, that could show Britain slumped into recession in the second half of 2023, ahead of a general election expected this year.

“It wouldn’t take much to tip it either way, frankly,” Bank of England governor Andrew Bailey told a parliamentary committee Wednesday.

According to analysts, a recession could put pressure on the BoE to cut rates as soon as May, meeting market forecasts and the same month traders expect the Federal Reserve to also begin reducing US borrowing costs.

Bailey voiced optimism for the UK economy in 2024, as he addressed the Economic Affairs Committee in the Lords, or upper house of parliament.

“Going forward, and I think this is in some ways more significant, we are now seeing some signs of the beginning of a pick-up in some of the surveys, for instance…we’ve got a modest pick-up this year which continues thereafter,” he said.

Britain’s economy shrank 0.1 percent in the third quarter of 2023 — and a fourth-quarter contraction would place it in a technical recession.

– ‘More evidence’ needed –

Inflation, however, remains the key data for central bankers.

“Bank of England policymakers are a very wary lot and will want more evidence that inflation will hug the (BoE) target…rather than drift upwards again before they are confident about cutting rates,” said Susannah Streeter, head of money and markets at Hargreaves Lansdown.

“However, given this slightly better-than-expected reading, the prospect for rate cuts this year is more encouraging.”

UK annual inflation has tumbled since striking a 41-year peak of 11.1 percent in October 2022.

Global inflation soared as the invasion of Ukraine by major oil and gas producer Russia two years ago sent energy prices rocketing.

The Bank of England and its peers have helped to cool inflation by hiking interest rates several times up until last year.

Higher gas and electricity bills were the main upward contributor to UK inflation in January, but this was offset by falling prices for furniture and food, which dropped month-on-month for the first time in more than two years.

“The cost of second-hand cars went up for the first time since May,” ONS chief economist Grant Fitzner also noted.

Recent falls in wholesale energy costs, falling wages growth and limited fallout on oil prices from the Middle East conflict should help dampen inflationary pressures in the coming months, according to EY analyst Martin Beck.

“The ingredients remain in place…to start cutting interest rates in the next few months,” added Beck.

“Overall, the latest inflation data should reassure (policymakers) that the time to start cutting interest rates is approaching.”

– ‘Huge progress’ –

Britain’s Conservative finance minister Jeremy Hunt said despite the steady rate, inflation was on a downward trend.

“Inflation never falls in a perfect straight line…We have made huge progress in bringing inflation down from 11 percent,” insisted the chancellor of the exchequer.

As expected, the main opposition Labour party — far ahead of the ruling Conservatives in opinion polls — attacked the government’s economic record.

“Inflation is still higher than the Bank of England’s target and millions of families are struggling with the cost of living,” argued Labour finance spokeswoman Rachel Reeves.