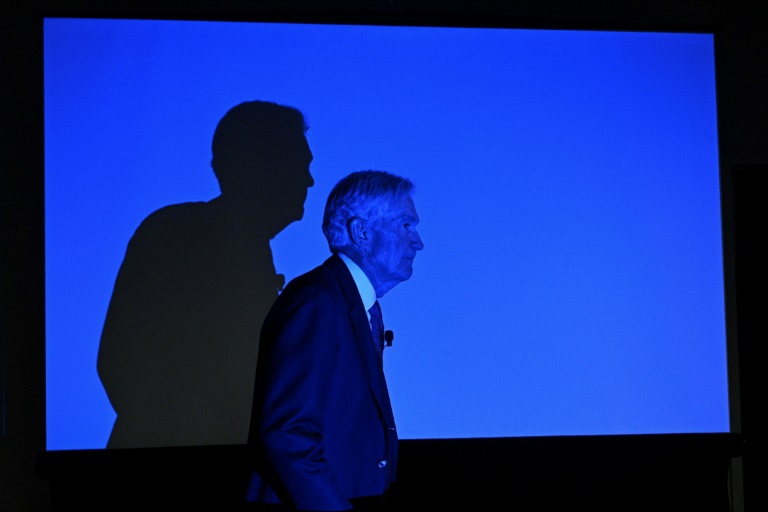

New York (AFP) – European and US equities pushed higher on Wednesday, with Wall Street striking fresh records, as comments by US Federal Reserve chief Jerome Powell lifted hopes of interest-rate cuts later this year.

All three major US indices closed up more than one percent, pushing both the S&P 500 and Nasdaq to yet another record close.

“US stocks and their relentless quest for fresh record highs is lifting European stocks,” said Kathleen Brooks, research director at XTB.

London, Frankfurt and Paris rebounded from recent losses sparked by French post-election uncertainty.

The dollar fell against both the euro and the pound as the market digested Powell’s latest round of congressional testimony.

Powell told a US House of Representatives panel that the central bank would not wait until inflation hit two percent before considering a rate cut.

“We’ve said that you don’t want to wait until inflation gets all the way down to two percent, because inflation has a certain momentum,” Powell said.

“If you waited that long, you’ve probably waited too long.”

Treasury bond yields retreated, with analysts citing strong demand at a 10-year Treasury note auction.

Spartan Capital’s Peter Cardillo said Wednesday’s rally was notable one day before the market sees key new US consumer price data.

“Powell is basically telegraphing to the market that we are having a rate cut in September,” Cardillo said.

“That’s what’s behind the move here.”

But analysts said Thursday’s report would be an important input.

“Thursday’s CPI data could be crucial in determining whether the probability of a September rate cut increases further from the current 70 percent,” said SPI Asset Management’s Stephen Innes.

But rate cut expectations in Britain are receding after Bank of England officials step up warnings about sticky inflation, XTB’s Brooks said, with the market now pricing in only a slightly better than 50-50 chance the BoE will begin easing interest rates next month.

“This has put upward pressure on the pound,” said Brooks, making it the best performer among leading currencies.

In Asia on Wednesday, Hong Kong stocks finished in the red after earlier rising more than one percent.

Shanghai closed lower, and Sydney, Mumbai and Manila were also down.

But Tokyo stocks advanced with the benchmark Nikkei 225 reaching an all-time high.

Seoul was flat, while Taipei, Wellington, Bangkok, Singapore, Jakarta and Kuala Lumpur all rose.

© 2024 AFP