London (AFP) – Global equities rose on Monday while gold soared to a new record peak at the start of a busy week that will include a eurozone interest rate decision and key US inflation data.

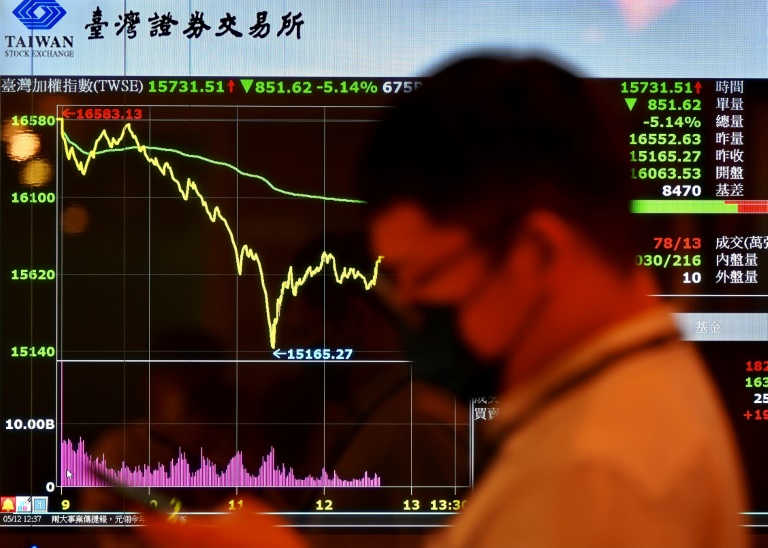

Most Asian markets squeezed out gains as traders weighed the chances of the US Federal Reserve cutting interest rates this year after a forecast-busting US jobs report on Friday dented hopes for a first move in June.

The positive disposition rolled over into European trading and Wall Street edged higher after wobbling at the start of the trading session.

“The sense of optimism could stem from the fact the week holds a lot of big events, including the European Central Bank’s interest rate decision on Thursday,” said Sophie Lund-Yates, lead equity analyst at stockbroker Hargreaves Lansdown.

“There’s an expectation that (ECB) rates will be held at 4.5 percent, and even more important will be the commentary around the decision, as investors look for clues of cuts coming in the summer.”

Gold prices spiked as high as $2,353.95 per ounce on Monday to extend its record-busting streak, buoyed by its haven qualities amid ongoing Middle East turmoil.

Oil fell, with Brent falling below $90 per barrel despite Israel and Hamas dampening hopes of a speedy breakthrough in talks on a ceasefire and hostage release deal.

Later this week, market participants on Wednesday will also seize upon hotly-awaited US inflation data that could shed light on the Fed’s monetary policy outlook.

Wall Street’s three main indexes rallied on Friday following news that 303,000 jobs were created in the United States in March, with investors focusing on the positives for the economy instead of monetary policy implications.

However, observers warned that the figures — which also showed unemployment falling and wage growth still strong — could prevent the Fed from cutting rates three times in 2024, as it has previously indicated.

Traders are also awaiting the release this week of minutes from the Fed’s most recent meeting, as well as the consumer price index inflation reading.

The CPI “will be a bigger test of whether the recent inflation bump is a trend or not”, said Saxo’s Redmond Wong, referring to bigger-than-expected inflation figures at the start of the year.

There is now growing talk that the Fed will not even be able to cut rates three times this year, with some suggesting that if data continued to come in strongly then officials could face pressure to hold off until 2025.

“The question now is if pricing in ‘higher for longer’ on rates will bust the bullish narrative” that has seen leading indices to new records in recent months, said David Morrison, senior market analyst at Trade Nation.

For Briefing.com’s Patrick O’Hare the corporate earnings season that kicks off later this month “will be the litmus test” for the stock market rally.

“The stock market has kept its bullish posture amid some burgeoning confidence that earnings (and earnings expectations) will hold up given economic data that continue to surprise, in aggregate, to the upside,” he said in a note to clients.

– Key figures around 1530 GMT –

New York – Dow: UP 0.1 percent at 38,943.80 points

New York – S&P 500: UP 0.1 percent at 5,211.15

New York – Nasdaq Composite: UP 0.2 percent at 16,286.20

London – FTSE 100: UP 0.4 percent at 7,943.47 (close)

Paris – CAC 40: UP 0.7 percent at 8,119.30 (close)

Frankfurt – DAX: UP 0.8 percent at 18,318.97 (close)

EURO STOXX 50: UP 0.6 percent at 5,046.05 (close)

Tokyo – Nikkei 225: UP 0.9 percent at 39,347.04 (close)

Hong Kong – Hang Seng Index: UP 0.1 percent at 16,732.85 (close)

Shanghai – Composite: DOWN 0.7 percent at 3,047.05 (close)

Dollar/yen: UP at 151.83 yen from 151.61 yen on Friday

Euro/dollar: UP at $1.0855 from $1.0841

Pound/dollar: UP at $1.2650 from $1.2637

Euro/pound: UP at 85.81 pence from 85.75 pence

Brent North Sea Crude: DOWN 1.4 percent at $89.91 per barrel

West Texas Intermediate: DOWN 1.2 percent at $85.89 per barrel

burs-rl/bc

© 2024 AFP