New York (AFP) – Electric automaker Tesla has launched a charm offensive to try to coax shareholders to vote Thursday for billionaire CEO Elon Musk’s giant pay package, after the windfall was nixed in court.

The company has mounted a social media campaign and even invited shareholders to enter a sweepstakes to win a tour of Tesla’s Gigafactory in Texas, personally escorted by designer Franz von Holzhausen and Musk, on the eve of the annual meeting.

The contest winners — 15 shareholders picked at random — will also have reserved seats at the June 13 meeting, at which investors will also vote on a plan to shift Tesla’s place of incorporation from Delaware to Texas.

The automaker has depicted the vote as a do-or-die moment for the company.

“The future value we are poised to deliver for you is at risk,” the company says on a website for the annual meeting.

“We need your vote NOW to protect Tesla and your investment.”

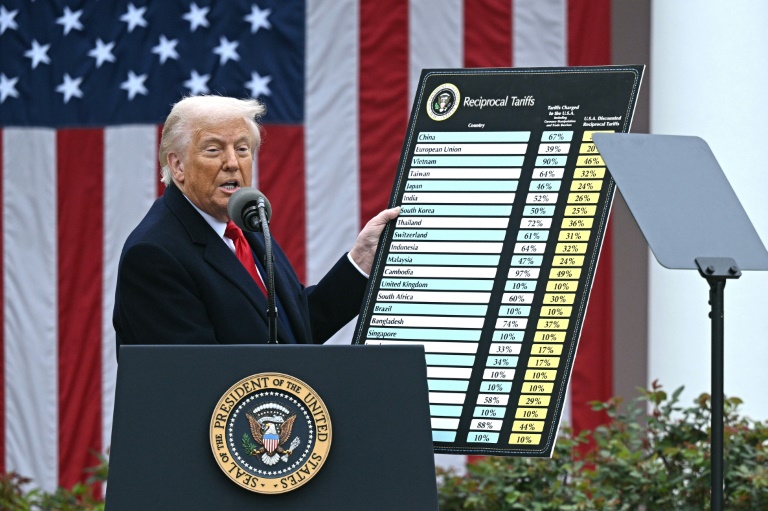

In March 2018, shareholders backed the package, under which Musk stands to potentially make $56 billion.

It was designed to reward the 52-year-old founder for Tesla’s significant growth.

But in January this year, a Delaware judge nullified the package, ruling that it was devised in a “deeply flawed” manner given Musk’s extensive ties to key Tesla directors who blessed the plan.

Musk’s pay package was “the largest potential compensation opportunity ever observed in public markets by multiple orders of magnitude,” Judge Kathaleen McCormick wrote in a ruling in favor of a shareholder who challenged the plan.

In response, company leaders, including Tesla’s board chair Robyn Denholm, have thrown their weight behind Musk, viewing him as indispensable to the company’s future.

– ‘Ambitious’ or ‘excessive’? –

In April, Tesla revived the package, with Denholm imploring investors to “fix this issue” after the Delaware ruling.

“Tesla has been one of the most successful enterprises of our time. In just the past six years, we created more than $735 billion in value,” Denholm said in a letter to shareholders.

“Our next growth vector is equally as ambitious.”

But influential advisory firms Investor Shareholder Services and Glass Lewis have thrown cold water on the pay package, with ISS saying the value “remains excessive” and does not merit the backing of investors.

ISS also acknowledged misgivings about the Texas move, but concluded support for the shift “is warranted with caution.”

Glass Lewis called the pay package “excessively dilutive” for shareholders, and also urged rejection of the change in place of incorporation in light of the “substantial uncertainty” in the application of Texas law.

Among other large shareholders, Vanguard, which holds more than seven percent of shares, declined comment, while BlackRock, which holds around six percent, did not respond to a request for comment.

Tesla’s efforts have won support from billionaire investor Ron Baron, who said he will vote Baron Capital’s shares in favor of the plan.

Without Musk’s “relentless drive and uncompromising standards, there would be no Tesla,” Baron said in a public letter.

“Shareholders should ask themselves this question: is Tesla better off with or without Elon,” he said.

“At Baron Capital, our answer is clear, loud and unequivocal: Tesla is better with Elon. Tesla is Elon.”

But Norges Bank Investment Management, Norway’s sovereign wealth fund that held about one percent of Tesla shares at the end of 2023, is voting no.

“While we appreciate the significant value generated under Mr. Musk’s leadership since the grant date in 2018, we remain concerned about the total size of the award, the structure given performance triggers, dilution, and lack of mitigation of key person risk,” Norges said.

Musk’s reaction?

“Yeah, this is not cool,” he posted on X, his social media platform.

© 2024 AFP