Washington (AFP) – US President Donald Trump’s punishing tariffs on dozens of economies came into force Wednesday, including over 100 percent on China, as Beijing vowed “forceful” action in an intensifying trade war that sparked fresh panic on the markets. Following the sweeping 10 percent tariffs that took effect over the weekend, rates on imports to the United States from exporters like the European Union or Japan rose further at 12:01 am (0401 GMT) Wednesday. China — Washington’s top economic rival but also a major trading partner — is the hardest hit, with tariffs imposed on its products since Trump returned to the White House now reaching a staggering 104 percent.

In response, Beijing’s foreign ministry promised to take “firm and forceful” steps to protect its interests, while its commerce ministry said the country had “abundant means” to fight a trade war. Trump has said his government was working on “tailored deals” with trading partners, with the White House saying it would prioritize allies like Japan and South Korea. His top trade official Jamieson Greer also told the Senate that Argentina, Vietnam, and Israel were among those who had offered to reduce their tariffs. Trump told a dinner with fellow Republicans on Tuesday night that countries were “dying” to make a deal. “I’m telling you, these countries are calling us up kissing my ass,” he said.

But Beijing has shown no signs of standing down, vowing to fight a trade war “to the end” and promising countermeasures to defend its interests. A government white paper released Wednesday, however, stressed the two countries could still resolve their differences “through equal-footed dialogue and mutually beneficial cooperation.” China’s retaliatory tariffs of 34 percent on US goods are due to enter into force at 12:01 am local time on Thursday (1601 GMT Wednesday). Residents in Beijing expressed fears over the escalating trade war, with lawyer Yu Yan urging dialogue. “I hope that everyone can sit down and reconcile and talk, and then put things out step by step, rather than irrationally escalate them,” she told AFP.

In the United States, consumers also voiced worries over rising prices. At a supermarket in New York, Anastasia Nevin told AFP she is currently in “survival mode.” “I have two kids so I’m just trying to get by. It’s tough,” she said Tuesday, adding she would likely need to cut back on spending if prices rise further.

The US president believes his policy will revive America’s lost manufacturing base by forcing companies to relocate to the United States. But many business experts and economists question how quickly — if ever — this can take place, warning of higher inflation as the tariffs raise prices. Trump said Tuesday the United States was “taking in almost $2 billion a day” from tariffs. Trump originally unveiled a 34 percent additional tariff on Chinese goods. But after China countered with its own tariff of the same amount on American products, Trump piled on another 50 percent duty. Taking into account existing levies imposed in February and March, that brings the cumulative tariff increase for Chinese goods during Trump’s second presidency to 104 percent.

Trump has insisted the ball was in China’s court, saying Beijing “wants to make a deal, badly, but they don’t know how to get it started.” Late Tuesday, Trump also said the United States would announce a major tariff on pharmaceuticals “very shortly.” Separately, Canada said that its tariffs on certain US auto imports will come into force Wednesday.

After trillions in equity value were wiped off global bourses in the last days, markets in Asia came under pressure again on Wednesday, with Hong Kong plunging more than three percent before paring some losses at close. Japan’s Nikkei closed down 3.9 percent and Taiwan stocks shed 5.8 percent, while European markets sank at open. Foreign exchange markets likewise witnessed ructions, with the South Korean won falling to its lowest level against the dollar since 2009 this week. China’s offshore yuan also fell to an all-time low against the US dollar, as Beijing’s central bank moved to weaken the yuan on Wednesday for what Bloomberg said was the fifth day in a row. Analyst Stephen Innes said however, that “letting the yuan grind lower at this measured pace won’t offset the blow from a full-blown tariff barrage.” “The levies are simply too big. China is trying to thread the needle, but the runway is short,” he warned. Oil prices slumped, with the West Texas Intermediate closing below $60 for the first time since April 2021.

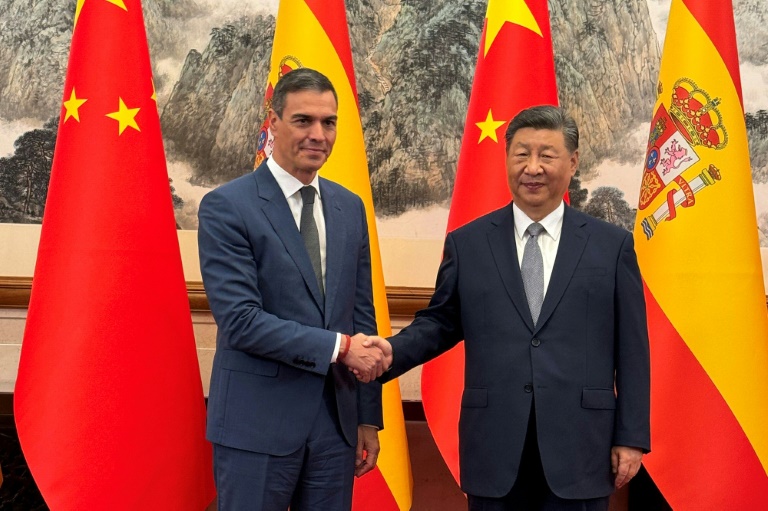

The European Union has sought to cool tensions, with the bloc’s chief Ursula von der Leyen warning against worsening the trade conflict in a call with Chinese Premier Li Qiang. She stressed stability for the world’s economy, alongside “the need to avoid further escalation,” said an EU readout. The Chinese premier told von der Leyen that his country could weather the storm, saying it “is fully confident of maintaining sustained and healthy economic development.” The EU — which Trump has criticized bitterly over its tariff regime — may unveil its response next week to new 20 percent levies it faces. In retaliation against US steel and aluminum levies that took effect last month, the EU plans tariffs of up to 25 percent on American goods ranging from soybeans to motorcycles, according to a document seen by AFP.

© 2024 AFP