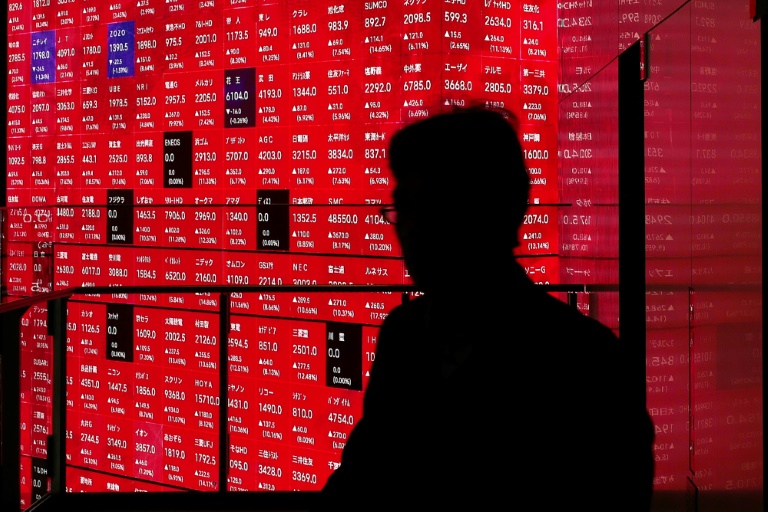

Washington (AFP) – The mighty dollar is sliding sharply as President Donald Trump’s turbulent trade agenda has battered US credibility in global markets and fanned fears of a self-inflicted economic downturn. The US currency fell by another two percent on Friday to hit a three-year low against the euro to $1.14, before paring back some losses. A weaker dollar could drive inflation in the United States by making imports more expensive, squeeze the profit margins of companies, and make US markets less attractive to foreign investors.

It has been a sharp reversal of fortune for the greenback, which had soared in the wake of Trump’s November election victory. Back then, there was talk that the dollar’s ascent could bring the euro down to parity with the US currency as investors welcomed Trump’s plans for tax cuts and smaller government. “The US was really at its peak,” recalled Adam Button of ForexLive. “Now it’s slipping in dramatic fashion.” The euro has gained almost 10 percent against the dollar since Trump returned to the White House on January 20, when the currencies stood near parity at $1.04.

The dollar was rocked in recent days by Trump’s stop-start tariffs announcements: The US leader announced universal duties last week, only to implement but quickly remove some of the harshest ones this week. “We don’t have a lot of trade wars to look back on, especially in the last 90 years,” Button said. “So modern markets have never dealt with this kind of shock.”

– ‘Damage done’ –

George Saravelos, global head of foreign exchange research at Deutsche Bank, said that despite Trump’s tariffs U-turn, “the damage to the USD (dollar) has been done.” “The market is re-assessing the structural attractiveness of the dollar as the world’s global reserve currency and is undergoing a process of rapid de-dollarization,” Saravelos said in a note to clients. While Trump froze higher tariffs on scores of countries this week, he left a 10 percent universal duty that went into effect last week in place. At the same time, he escalated a trade war with China, applying a 145 percent levy on goods from the world’s second biggest economy, which retaliated on Friday with a 125 percent levy on US goods. Some other Trump tariffs have also had staying power, such as sectoral levies on auto imports, steel and aluminium.

“Global recession is now our baseline forecast as higher tariffs and retaliatory measures take hold,” said a JPMorgan Chase research note released Monday.

– Still strong –

Amid the unrest in financial markets, investors have turned to other assets such as gold and the Swiss franc, which have soared higher. The movement against the dollar is “a bit of a momentum trade and a bit of an acknowledgement that the tone of US exceptionalism is being peeled back,” said Briefing.com analyst Patrick O’Hare. “You have foreign investors who are losing confidence in their US investments because of the policy volatility,” O’Hare added.

Market watchers say it is too early to say whether the recent decline in the greenback portends any deeper shift. The long-term health of the dollar is an evergreen topic of debate, and the currency has endured earlier moments of doubt. O’Hare noted that the dollar is still “relatively strong” compared with its trading level at other times, including during the 2008 financial crisis.

© 2024 AFP