London (AFP) – Shares slipped in New York and Europe Thursday as the latest US inflation report strengthened the case for a slower pace of interest rate cuts and dented a recent rally. All three major US Wall Street indexes were marginally lower in midday trading, after the Dow and the wider S&P 500 had chalked up all-time highs Wednesday. In Europe, Paris, Frankfurt, and London all closed slightly lower.

Earlier in the day, Chinese stock markets rebounded somewhat after China’s central bank took action to boost purchases of company shares. As measured by the consumer prices index, US annual inflation slowed to 2.4 percent in September from 2.5 percent in August, the government reported. But a core measure of inflation that strips out volatile food and energy costs rose to 3.3 percent from 3.2 percent in August. Both figures were faster than what analysts had expected, and combined with a strong US jobs report last week, they weakened the case for the US Federal Reserve to aggressively cut lending rates.

“The latest CPI figures are hardly a disaster, but after a far stronger-than-expected jobs report last week, many are questioning the Fed’s decision to cut by 50 basis points last month,” said Bret Kenwell, analyst at eToro. “The two reports have all but taken another 50 basis point cut off the table next month, while some could argue that it rules out a rate cut of any kind in November.” However, there was some contradictory news Thursday, with the number of jobless Americans filing for benefits last week jumping to 258,000, the highest level in a year. Analysts warned the often-volatile statistic could have been distorted by hurricanes across the south-east of the country.

“Today’s CPI and jobless claims look bearish for stocks. They point to inflation remaining sticky even as the labor market stumbles,” said Joe Mazzola, a strategist at Charles Schwab. “However, it’s dangerous to make sweeping economic judgments based on a single month or week of data, and initial market reaction appears muted,” he said.

In London on Thursday, shares in GSK jumped more than three percent after the British pharmaceutical company agreed to pay $2.3 billion in the United States to end lawsuits alleging that its Zantac heartburn drug caused cancer. Earlier in the day, Shanghai’s stock market closed 1.3 percent higher Thursday and Hong Kong rose 3.0 percent. Hong Kong and mainland markets whipsawed this week as the euphoria over China’s recent moves to boost its economy was dampened by a news conference that failed to unveil more measures or give details on those already announced.

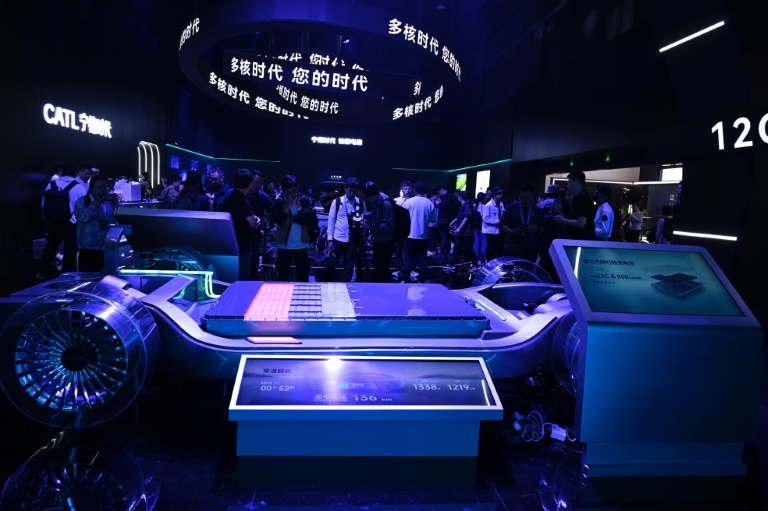

On Thursday, however, investors welcomed news that the People’s Bank of China had released details of a “swap facility” that will allow “qualified securities, funds, and insurance companies” to access more than $70 billion in liquidity to purchase equities. Oil prices jumped more than two percent after Israel’s defence minister pledged that his country will strike Iran in retaliation for last week’s missile attack.

– Key figures around 1540 GMT –

New York – Dow: DOWN 0.3 percent at 42,402.78 points

New York – S&P 500: DOWN 0.2 percent at 5,782.34

New York – Nasdaq Composite: DOWN 0.1 percent at 18,279.77

Shanghai – Composite: UP 1.3 percent at 3,301.93 (close)

Hong Kong – Hang Seng Index: UP 3.0 percent at 21,251.98 (close)

London – FTSE 100: DOWN 0.1 percent at 8,237.73 (close)

Paris – CAC 40: DOWN 0.2 percent at 7,541.59 (close)

Frankfurt – DAX: DOWN 0.2 percent at 19,210.90 (close)

Tokyo – Nikkei 225: UP 0.3 percent at 39,380.89 (close)

Brent North Sea Crude: UP 2.4 percent at $78.39 per barrel

West Texas Intermediate: UP 2.3 percent at $74.93 per barrel

Euro/dollar: UP at 1.0926 from $1.0940 on Wednesday

Pound/dollar: UNCHANGED at $1.3046

Dollar/yen: DOWN at 148.53 yen from 149.35 yen

Euro/pound: UP at 83.74 pence from 83.72 pence

© 2024 AFP