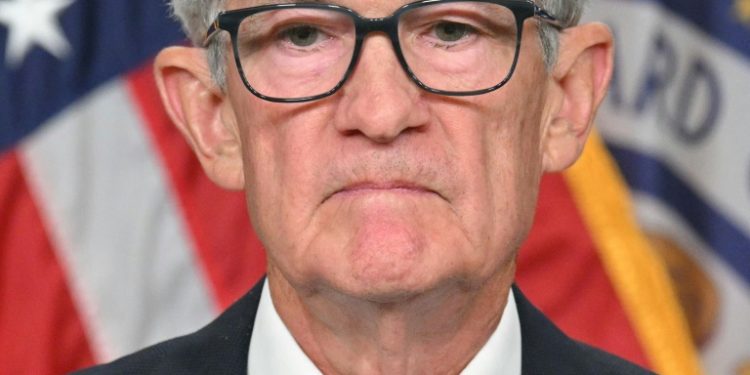

Washington (AFP) – The US Federal Reserve is widely expected to cut interest rates by a quarter point Thursday, looking beyond the election results to continue easing borrowing costs on the back of cooling inflation. The second day of interest rate deliberations began at 9:00 am local time (1400 GMT) in Washington, as scheduled, the Fed said in a statement. The decision will be published at 2:00 pm local time, followed by a press conference from Fed Chair Jerome Powell.

The Fed sits just a short walk from the White House, where Democratic President Joe Biden will soon hand back the keys to Donald Trump following the Republican’s election win. Despite the political whiplash, analysts expect Fed policymakers will want to eschew any drama and focus on their job. “We still expect them to cut, at least in November,” KPMG Chief Economist Diane Swonk told AFP Wednesday.

After hiking interest rates to a two-decade high last year in a bid to control runaway inflation, the Fed recently began lowering its key lending rate again, cutting by half a percentage point in September and signaling more to come. Since then, the Fed’s favored inflation gauge has eased to 2.1 percent, while economic growth has remained robust. The labor market has also stayed strong overall — despite a sharp hiring slowdown last month attributed in large part to adverse weather conditions and a labor strike.

“Generally speaking, the US economy looks quite resilient, and the labor market still looks very good,” Jim Bullard, the long-serving former St. Louis Fed President, told AFP ahead of election day. Bullard, who retired from the Fed last year to become dean of the Daniels School of Business at Purdue University, expects the Fed to lower its key lending rate by 25 basis points this week to between 4.50 and 4.75 percent. He then expects policymakers to cut by the same amount at the final rate meeting of the year, in December.

– ‘Keep the door open’ –

Futures traders also overwhelmingly expect the Fed to cut by a quarter percentage point this week, assigning such a scenario a probability of more than 95 percent on Wednesday, according to data from CME Group. Analysts are less certain about December’s rate decision. CME Group data implies a roughly 70 percent chance of a further quarter-point cut.

“The December rate cut decision will depend on labor market data and we expect a further softening to lead to a 50bp (basis point) rate cut,” economists at Citi wrote in a client note ahead of Election Day. KPMG’s Swonk said policymakers “are expected to keep the door open a crack to a (December) cut, but with a high level of uncertainty in terms of how the economy is performing and inflation.”

– ‘Tug of war’ –

Both Harris and Trump proposed policies on the campaign trail that independent analysts say would increase the size of the deficit, pushing up the overall US debt pile and potentially raising the cost of government borrowing as a result. But even with a Trump victory now assured, a lot still depends on whether Republicans can pull off a “Red Sweep” of not only the White House and Senate but also the House of Representatives.

“Markets tend to like divided government as a way to control spending and keep deficits down,” said Purdue University’s Bullard. “What’s distressing to an economist like me is that, really, fiscal discipline has broken down for both political parties,” he said. After the rate decision is announced, Fed Chair Jerome Powell will hold a press conference where he is likely to field questions about what the election means for Fed policy — and for his own job at the top of the institution.

Donald Trump has repeatedly accused Powell — whom he first appointed to run the US central bank — of working to favor the Democrats and has suggested he would look to replace him once his term expires in 2026. Trump has also said he would like “at least” a say over setting the Fed’s interest rate — something that runs against the Fed’s current mandate to act independently to tackle inflation and unemployment.

© 2024 AFP