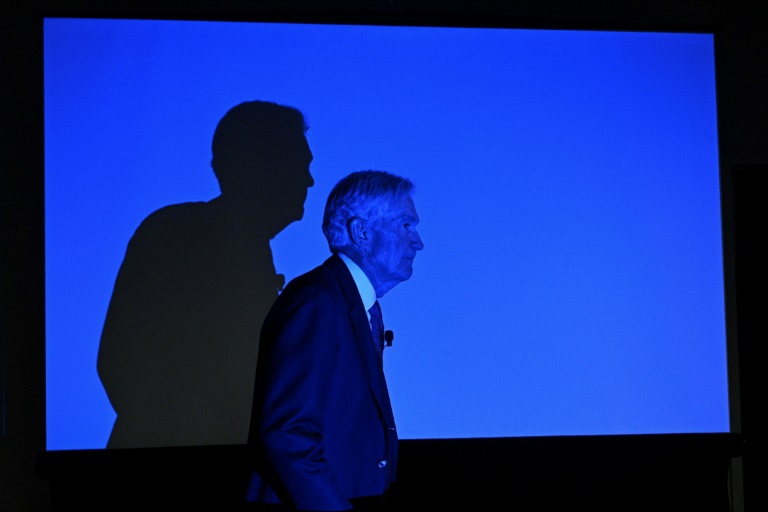

Washington (AFP) – A strong US economy and an uptick in inflation led the Federal Reserve’s rate-setting committee to conclude that progress against rising prices had stalled, according to minutes of its most recent meeting published Wednesday.

Fed policymakers voted to hold rates at a 23-year high after the rate-setting meeting concluded on May 1, as they sought to tackle inflation still stuck firmly above the bank’s long-term target of two percent. The minutes of the two-day Federal Open Market Committee (FOMC) meeting show that policymakers generally felt that “recent data had not increased their confidence that inflation was moving sustainably toward two percent.”

The disappointing inflation data, and the strong economic figures in the first quarter, led them to conclude that “it would take longer than previously anticipated” for them to be confident that inflation was trailing off, the Fed said. Several FOMC members said they thought aggregate demand growth would need to slow down for the target to be reached. Various policymakers also “mentioned a willingness to tighten policy further should risks to inflation materialize in a way that such an action became appropriate,” the Fed added.

On a more positive note, the Fed minutes noted that “medium- and longer-term measures of expected inflation had remained well anchored, which was seen as crucial for meeting the committee’s inflation goal on a sustained basis.”

Futures traders currently assign a probability of close to 60 percent that the FOMC will vote to cut rates by mid-September, according to data from CME Group. A September rate cut would thrust the independent US central bank into the middle of a fractious presidential election campaign between Joe Biden and Donald Trump in which the US economy and the cost of living look set to feature.

© 2024 AFP