New York (AFP) – Wall Street stocks mostly fell Monday after fresh inflation data raised questions about US monetary policy, while gold prices shot to a fresh record.

The Institute for Supply Management’s March survey is the first to show US manufacturing activity rising since September 2022. But markets fixated on a 3.3 percent rise in the ISM’s prices index as compared with February.

“The market turned around when ISM came up this morning,” said Jack Ablin of Cresset Capital. “This is one sign that could show that the inflation is picking up more.”

While the Nasdaq mustered a narrow gain, both the Dow and S&P 500 retreated. Markets have been scrutinizing inflation data to gauge the likelihood of a shift in monetary policy. The Federal Reserve has said it expects three interest rate cuts this year, but that plan could slide if inflation remains elevated. US Treasury yields jumped after Monday’s ISM data.

In Asian trade, Seoul, Singapore and Manila rose, while there were losses in Taipei and Jakarta. Hong Kong, Sydney, Wellington, London, Paris and Frankfurt were closed for Easter Monday. Gold hit a record high of $2,265.73, according to Bloomberg News, extending the year’s rally fueled by central bank hints at an easing of credit conditions. It is also being supported by its attraction as a safe haven in times of turmoil, with geopolitical tensions growing.

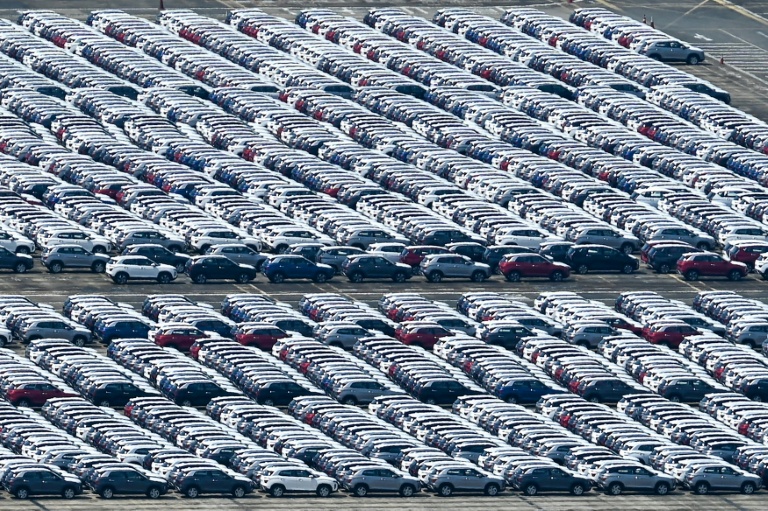

Shanghai jumped around one percent as traders welcomed news that China’s manufacturing grew for the first time in half a year, giving a boost to leaders as they battle to kickstart the struggling economy. The 50.8 reading in March was the first showing expansion since September and was well above forecasts. “The industrial sector seems to be resilient, partly helped by strong exports,” said Zhang Zhiwei at Pinpoint Asset Management. “If fiscal spending rises and exports remain strong, the economic momentum may improve.”

But Tokyo sank more than one percent as the Bank of Japan’s closely watched Tankan survey showed that confidence among Japan’s largest manufacturers slipped in the first quarter, having risen for three straight quarters.

– Key figures around 2040 GMT – New York – Dow: DOWN 0.6 percent at 39,566.85 (close) New York – S&P 500 – DOWN 0.2 percent at 5,243.77 (close) New York – Nasdaq – UP 0.1 percent at 16,396.83 (close) Tokyo – Nikkei 225: DOWN 1.4 percent at 39,803.09 (close) Shanghai – Composite: UP 1.2 percent at 3,077.38 (close) Hong Kong – Hang Seng Index: Closed for holiday London – FTSE 100: Closed for a holiday Dollar/yen: UP at 151.65 yen from 151.35 yen on Thursday Euro/dollar: DOWN at $1.0746 from $1.0790 Pound/dollar: DOWN at $1.2548 from $1.2623 Euro/pound: UP at 85.61 pence from 85.48 pence West Texas Intermediate: UP 0.6 percent at $83.71 per barrel Brent North Sea Crude: UP 0.5 percent at $87.42 per barrel New York – Dow: UP 0.1 percent at 39,807.37 points (close)

© 2024 AFP