London (AFP) – Stock markets rose and gold hit new records Thursday as traders maintained hopes of interest-rate cuts by the European Central Bank and US Federal Reserve later this year.

Wall Street opened higher and European markets were up in afternoon deals, with the Paris CAC 40 index topping 8,000 points for the first time.

The ECB kept rates unchanged for a fourth straight meeting on Thursday, as expected, as sticky inflation is not easing as fast as hoped in the eurozone.

But the Frankfurt-based institution lowered its inflation forecast, expecting consumer price increases to slow faster than previously thought this year and return to its two-percent target in 2025.

“Given the revisions to the staff forecasts and the modestly changed wording to the statement, the ECB is inching closer to the first rate cut,” said Mark Wall, economist at Deutsche Bank.

Sylvain Broyer, economist at S&P Global Ratings, said: “Barring an accident affecting growth or financial stability, a cut in ECB rates in June is therefore the most likely scenario.”

Investors were also still digesting testimony by Fed chief Jerome Powell before Congress on Wednesday.

Powell flagged progress on bringing inflation towards the Fed’s two percent goal and said borrowing costs could be lowered as a result.

He warned that the battle was far from over, while investors are eyeing a first move in June after their March hopes were scrubbed by a strong inflation report last month.

“If the economy evolves broadly as expected, it will likely be appropriate to begin dialling back policy restraint at some point this year,” Powell told the House Financial Services Committee.

“But the economic outlook is uncertain, and ongoing progress toward our two percent inflation objective is not assured,” said Powell, who appears before the Senate on Thursday.

While prices have been tempered by the Fed’s decision to push rates to a two-decade high, officials have lined up to warn that cutting them too early could erase all their hard work.

Gold, a haven investment during times of geopolitical uncertainty, surged to a new all-time peak at $2,164.78 per ounce to extend its record-breaking run.

“Gold traders have been reacting to a subtle yet noticeable change in tone from the Federal Reserve, particularly after its Chairman publicly acknowledged on Wednesday the likelihood of a rate cut in the coming months,” said Ricardo Evangelista, senior analyst at ActivTrades.

“With the softening of the dollar, lower treasury yields, ongoing geopolitical instability, and concerns over global economic growth, the price of the precious metal is expected to remain well supported, and further gains should not come as a surprise,” he said.

A weaker US currency makes dollar-denominated commodities cheaper for buyers using stronger units, which tends to boost demand.

Focus will turn Friday toward US jobs data following a positive set of figures showing the labour market remained healthy but appeared to be softening.

– Key figures around 1455 GMT –

New York – Dow: UP 0.5 percent at 38,838.74 points

New York – S&P 500: UP 0.7 percent at 5,141.73

New York – Nasdaq Composite: UP 0.9 percent at 16,177.58

London – FTSE 100: UP 0.3 percent at 7,702.52

Paris – CAC 40: UP 0.9 percent at 8,023.96

Frankfurt – DAX: UP 0.6 at 17,827.54

EURO STOXX 50: UP 1.1 percent at 4,968.29

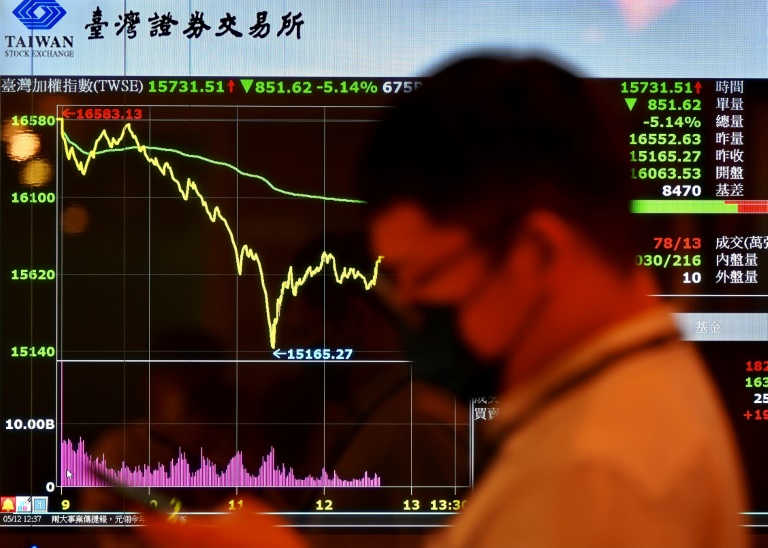

Tokyo – Nikkei 225: DOWN 1.2 percent at 39,598.71 (close)

Hong Kong – Hang Seng Index: DOWN 1.3 percent at 16,229.78 (close)

Shanghai – Composite: DOWN 0.4 percent at 3,027.40 (close)

Euro/dollar: UP at $1.0914 from $1.0899 on Wednesday

Dollar/yen: DOWN at 148.12 yen from 149.44 yen

Pound/dollar: UP at $1.2768 from $1.2732

Euro/pound: DOWN at 85.50 pence from 85.58 pence

Brent North Sea Crude: DOWN 0.6 percent at $82.48 per barrel

West Texas Intermediate: DOWN 0.8 percent at $78.53 per barrel

burs-lth/

© 2024 AFP